Xero is an award-winning online accounting software for small scale businesses. Xero offers a variety of features to make your business function smoothly and efficiently. The software handles all the accounting transactions effectively. It permits unlimited users to get online at a time and work in collaboration over data which is accessible through a single ledger. Xero also provides Bank Reconciliation services by importing the various transactions from your bank accounts and matching them with your cash-book. Business finances and cash-flow statements are updated on a real-time basis, helping you to keep a track of all your expenses and transactions.

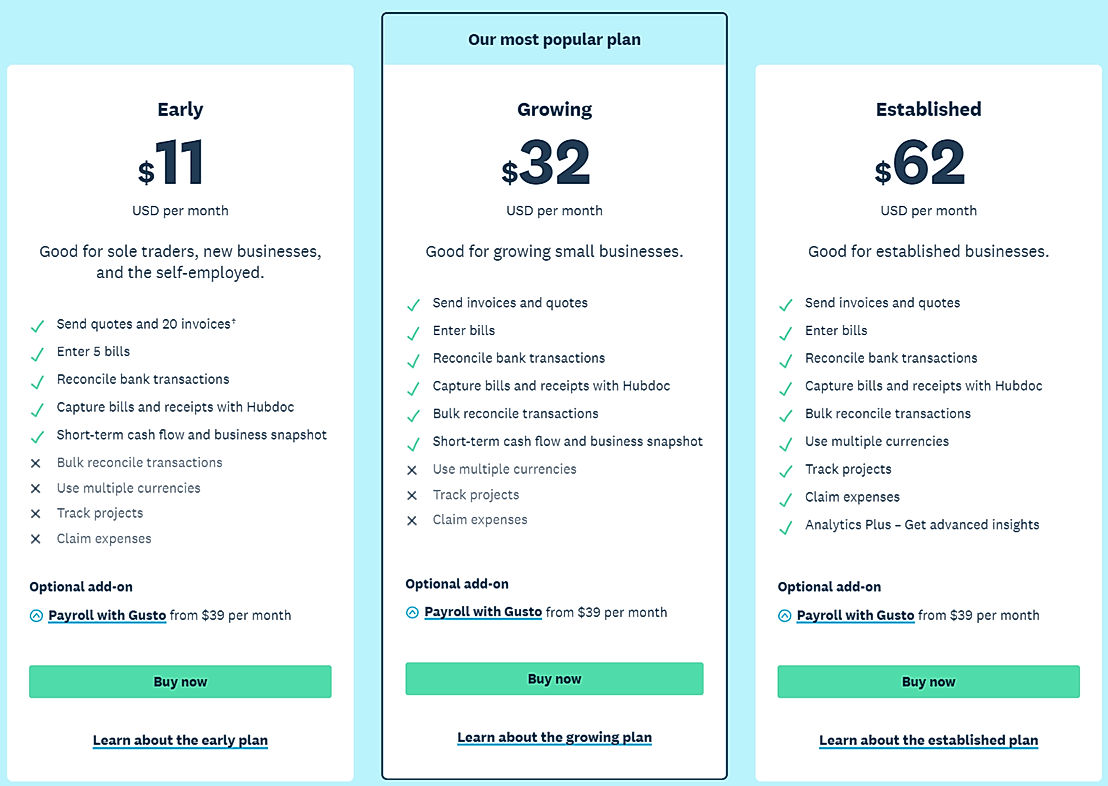

Pricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Free Trial

Available

No Credit Card Required, Get Started for Free

Pricing Options

Premium Plans ( Subscription )

Pricing Plans

Early $11.00 $11.00 per month

Good for sole traders, new businesses, and the self-employed

Features

Optional Add-ons

Growing $32.00 $32.00 per month

Good for growing small businesses

Features

Established $62.00 $62.00 per month

Good for established businesses

Features

Screenshots of Vendor Pricing Page

Learn more about Xero Pricing.

94% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Sponsored

90% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

85% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

93% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

78% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

80% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

96% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

How Xero will cha...

Introducing Xero ...

Pasted image

Business Performa...

Contacts and smar...

What is Xero used for?

Xero is Accounting Software. Xero offers the following functionalities:

Learn more about Xero features.

What are the top alternatives for Xero?

Does Xero provide API?

Yes, Xero provides API.

Vendor Details

Wellington, New ZealandContact Details

Not available

https://www.xero.com/

Social Media Handles

Top 10 Accounting & Bookkeeping Software Tools...

20 Best Payroll Software for Payroll Service Provid...

Top 5 Payroll Software for Small Businesses in 2023

Top 5 Budgeting and Forecasting Software in 2022

SaaS weekly roundup #22: Paddle acquires ProfitWell...

SaaS weekly roundup #17: Zendesk exploring a sale, ...

Top 10 Accounting Software for Small Businesses to ...

5 Best Open-Source and Free ERP Software to Use in ...

SaaS weekly roundup #20: cloud stocks see a dip, ac...

SaaS weekly roundup #10: Okta acquires Auth0, Hopin...

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.