A report by TechCrunch sheds light on how the SaaS sector is able to buck the venture slowdown, and if you’ve been a regular reader of the SaaS weekly roundup, you’d be concurring with the observations. While the investor’s appetite may be reducing, SaaS continues to attract their attention along with managing to be in the news with some major acquisitions as well. So without any further delay, here’s everything you need to know in the world of software-as-a-service.

Table of Contents

News of the week

Zendesk is working with adviser Qatalyst on potential sale

Zendesk has been in a news quite a lot these days. After a failed takeover attempt of SurveyMonkey’s parent company, it’s exploring a potential sale of its own business. It’s working with a new adviser, Qatalyst Partners, who’s reaching out to software companies and PE firms on its behalf. Although, Zendesk may choose to stay independent.

Whatfix acquires Leap.is to expand mobile capabilities

Leading digital adoption platform software Whatfix has announced the acquisition of Leap.is (formerly Jiny.io), a mobile-first platform for onboarding and assistance. The acquisition will help Whatfix offer DAP functionality to mobile apps.

The startup also introduced the Whatfix Studio, a content editor built on a low-code platform. In addition, it has launched Whatfix Hub along with revamping its desktop interface.

Related read: Interview with Khadim Batti, Co-Founder and CEO at Whatfix

Here’s why Brex just paid $90million for 10-person software startup Pry Financials

Corporate card company Brex is moving towards offering a financial operating system. To that end, it has acquired Pry Financials for $90million, which allows the companies to connect their bank accounts or integrate with QuickBooks or Xero to get an overview of the startups’ cash flow, burn rate, runway, and more.

Spring forward with Zoom Whiteboard, gesture recognition, Zoom IQ for Sales, and more

Video conferencing software Zoom has launched a slew of features, including gesture recognition where it can detect gestures like raising hands, thumbs up, etc. There’s also Zoom IQ for Sales, a conversational AI solution that can analyze customer interactions to offer insights and actions from sales meetings.

SaaS companies that got the funding this week

China’s work automation startup Laiye raises $160million, acquires France’s Mindsay

Work automation space is heating up as Chinese startup Laiye is aiming to go global. The one-stop platform for automating office tasks has closed a $160million funding round. The Series C investment also coincides with the acquisition of Paris-based chatbot software Mindsay.

Oyster, a remote workforce management platform, hits $1billion unicorn valuation

Amidst the pandemic, while video conferencing and event management software got a major boost, HR software also found a lot of takers. Hence, it’s not surprising to see Oyster – an HR platform focusing on distributed workforces – managing to raise $150million financing, helping it become a unicorn. The Series C round was by Georgian.

Mutiny, which personalizes website copy and headlines using AI, raises $50million

Mutiny is solving a particular challenge of the user expectations not meeting the ad they’ve clicked upon when they land on a website. It can create personalized website copies to match the ads. As part of Series B financing, it has received $50million, which was co-led by Tiger Global and Insight Partners. The investment will be used towards doubling its team size and improving the AI technology.

Videoverse offers AI tool to help enterprise videos go viral

With the explosion in video consumption, there are a lot of startups are aiming to help enterprises in creating and processing videos. Videoverse (previously Toch.ai) offers an AI-powered video editing platform. It has gotten $46.8million Series B funding led by A91 Partners.

Statsig raises $43million to help companies improve their software products

A/B testing has become quite common to understand what works better with users. Statsig has nabbed a $43million investment led by Sequoia Capital. It offers a cloud platform that lets customers carry out A/B tests at scale to improve their apps or websites.

SaaS-based investment management platform FundGuard has raised $40million. The Israeli startup managed to get large strategic investors such as Citi and State Street Corp for its Series B round.

SaaS demo platform Demostack raises $34million to expand to new markets

Demo experience platform Demostack has closed a $34million Series B round led by Tiger Global Management. The software allows customers to clone their product to create a demo environment for meetings with prospective clients.

In numbers

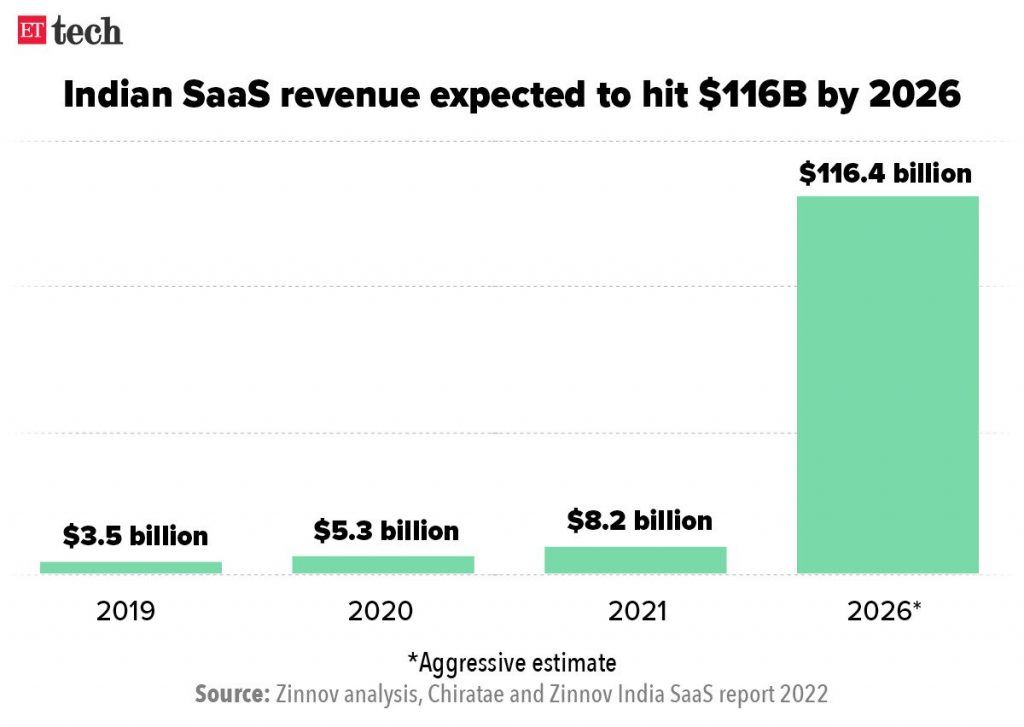

Read more: Funding for Indian SaaS to rise 62.5 percent to $6.5billion this year: report

Must reads

Beijing crackdown derails Alibaba’s bid for Amazon-size profit

Listen to

UserZoom: getting to $100million ARR by falling in love with a problem – with Alfonso de la Nuez

UserZoom, a SaaS sales product that delivers insights to businesses to improve their design and deliver better digital experiences, is one of the success stories to watch out for in the space. Its co-CEO Alfonso de la Nuez shares the inception of the company, what makes them stand out, and more.

A year in the life of a SaaS startup, with Meiran Galis (Scytale AI)

In this episode, Scytale AI’s CEO and co-founder Meiran Galis shares their learnings of one year into the startup. He talks about the idea, why compliance shouldn’t be overlooked, how CEOs can improve themselves, and more.

Watch

How to lower churn for SaaS and software: interview with growth expert Frederic Linfjärd

Frederic Linfjärd, Director of Growth at Planday talks about why churn is an important thing to focus on and why many don’t do that. He shares a practical example of how he managed to slash the churn by 50 percent in his previous stint.