|

|

95% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

93% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Start Free Trial

|

Sponsored

93% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

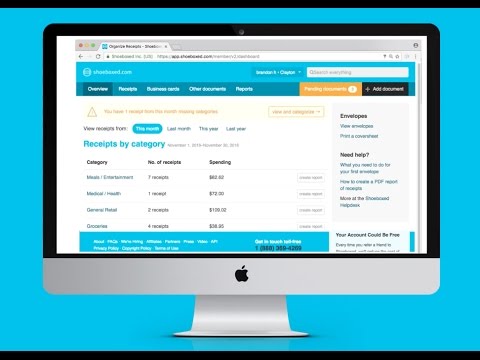

Shoeboxed

Visit Website

|

| Description | Pleo us an advanced expense management solution that offers smart business cards that automate expenditure reports and make business spending easier. It lets you provide each employee with a corporate ID card and set spending restrictions for each user individually. With Pleo, you can create Pleo cards with restrictions for your employees with a single click and you can immediately disable or enable them. The platform automates cost management so you and your team can focus your time and resources on the things that matter most. It keeps track of all of your team's spending in real time. Furthermore, it enables the admins to view all recurring software expenses in one location, allowing your staff to pay only for the tools they use. Pleo allows the users to be free of expenditure reports, stacks of receipts, and swapping business cards. It can be used to pay for the tools and services that your company needs and you can check out what everyone is signing up for too with Pleo. Pleo can be integrated with your accounting software. Read more | Qonto is an easy business banking solution for entrepreneurs and startups. This all-in-one online business accounting platform helps SMEs and freelancers create business accounts as per convenience. Thus getting access to simplified accounting flow and transparent solutions. The services and features delivered by this platform are trusted widely by over 2,00,000 businesses located in different parts of the globe. Organizations are provided with a secure platform that safeguards the funds through FGDR (a French financial crises operator) services. Also, access to MasterCard business cards, with SEBA and SWIFT transfers enabled, is available with a subscription to Qonto. Furthermore, users can enjoy facilities like automated bookkeeping and team expense management besides streamlining and optimizing their work effectively. Also, integration with top third-party applications like Slack, Accountable, AXA, Pennylane, Zettle, etc makes user-wise task management a lot simpler to handle. Beyond this, users can also depend on the same to create multiple accounts with dedicated IBANs for organized management of expense items, activities, and team budgeting. Read more | Shoeboxed is a compact receipt scanning and expense tracking software, helping out users turn receipts into data within no time. Receipts generated via Shoeboxed are clearly categorised, legibly scanned and easy to locate as well, ready for audit on the go. Moreover, precise scanning technology and inbuilt OCR/human data verification metrics are incorporated within the same, archiving and digitising individual receipts within a unified cum secured location. The collected receipts are thoroughly verified by professionals and then segregated into different categories/fully searchable documents on the go. An exclusive Magic Envelop service, helps users to get rid of paper piles by dumping them over mails and Shoeboxed gets them transformed into digitalised data in no time. For detailed expense reports both mobile device and web interface can be relied upon. Shoeboxed promises real-time integration with a variety of external platforms like Evernote, Wave, QuickBooks, HP, RightSignature, GoDaddy and more. Read more |

| Pricing Options |

|

|

|

| SW Score & Breakdown |

95% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

93% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

93% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| SaaSworthy Awards |

Not Available

|

# 11 Fastest Growing # 8 Most Popular |

Not Available

|

| Organization Types Supported |

|

|

|

| Platforms Supported |

|

|

|

| Modes of Support |

|

|

|

| API Support |

|

|

|

| User Rating |

|

|

|

| Rating Distribution |

|

|

|

| User Sentiments |

Excellent Customer Service, Easy to Use Interface, Extensive Integrations, Time-Saving Efficiency Occasional App Instability, Limited Offline Functionality, Inconsistent Receipt Fetching, Limited Card Acceptance In Specific Locations |

Easy Account Setup, Efficient Customer Service, User-Friendly Interface, Fast Transaction Speed Check Deposit Processing Delays, Account Closures, Lack of Physical Branches, Limited International Transfer Options |

Ease of receipt uploads, Receipt organization and categorization, Accurate data extraction from receipts, Mobile app convenience Slow processing times for receipts, Occasional bugs and glitches, Inaccurate data extraction in some cases, Limited features in the free version |

| Review Summary |

Users appreciate Pleo's user-friendly interface, ease of use, and ability to streamline expense management. They find it particularly helpful for tracking and categorizing expenses, setting spending limits, and generating reports. Additionally, Pleo's integration with various accounting and financial tools is highly valued. However, some users have mentioned occasional technical glitches and a limited range of features compared to more comprehensive expense management solutions. Overall, Pleo is well-received for its user-friendly design, efficient expense tracking, and integration capabilities. |

Review analysis indicates that users generally appreciate Qonto's user-friendly interface, efficient customer support, and innovative features for managing finances. Many users highlight the convenience of integrating their business accounts, categorizing transactions, and tracking expenses. However, some reviewers express concerns regarding occasional technical glitches, limited customization options, and high fees associated with specific services. Overall, users acknowledge Qonto's effectiveness in simplifying financial management but suggest improvements in stability, flexibility, and pricing transparency. |

Shoeboxed users generally appreciate its ease of use, time-saving features, and accurate data capture. The mobile app is praised for its convenience and the ability to quickly scan and upload receipts. However, some users report occasional syncing issues and suggest improvements to the user interface for better organization. They also express a desire for more robust reporting capabilities and seamless integration with accounting software. Overall, users find Shoeboxed helpful for managing receipts and tracking expenses, but some areas need improvement to enhance user experience and functionality. |

| Pros & Cons |

|

|

Not Available

|

| Read All User Reviews | Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Free Free Pro Others Premium Custom |

Basic Pack (Company Creators) Others Smart Pack (Company Creators) Others Essential Pack (Company Creators) Others Basic (Self-Employed) Others Smart (Self-Employed) Others Premium (Self-Employed) Others Essential (Micro-businesses (1-9 Employees)) Others Business (Micro-businesses (1-9 employees)) Others Enterprise (Micro-businesses (1-9 Employees)) Others Business (SMEs (10-250+ employees)) Others Enterprise (SMEs (10-250+ Employees)) Others Build Your Own (SMEs (10-250+ Employees)) Custom |

Startup $18.00 $22.00 per month Professional $36.00 $45.00 per month Business $54.00 $67.00 per month |

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

|

WIISE

4.8 Based on 4 Ratings

|

||

| Screenshots |

+ 2 More

|

Not Available | Not Available |

| Videos |

+ 1 More

|

|

+ 2 More

|

| Company Details | Located in: London, United Kingdom Founded in: 2015 | Located in: Paris, France Founded in: 2016 | Located in: Durham, North Carolina Founded in: 2007 |

| Contact Details |

Not available https://www.pleo.io/ |

+33 1 76 41 03 08 https://qonto.com/ |

+1 919-687-4269 https://www.shoeboxed.com/ |

| Social Media Handles |

|

|

|

What are the key differences between Pleo and Qonto?

What are the alternatives to Pleo?

Which SaaS products can Pleo integrate with?

What are the key features of Qonto?

What are the alternatives to Qonto?

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.