| Remove All |

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Quote

|

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Quote

|

Sponsored

92% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

OnPay

Visit Website

|

Sponsored

76% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Remofirst

Visit Website

|

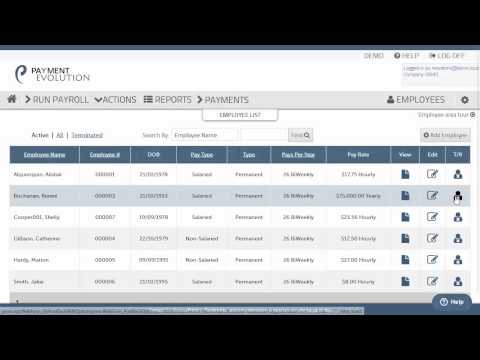

| Description | PaymentEvolution Payroll software is specially designed to cater to your employee payment needs. Custom payment rules for benefits, deductions and earnings are possible with this software. The tool always keeps the users updated with recent developments in tax tables. You can also keep employments records using PaymentEvolution Payroll software. The software is cloud based so you can access it from any web browser without any hassle. It provides detailed online payment history, and you can avail payment statement & payslips using your desktop/mobile/table. PaymentEvolution Payroll comes integrated with the world’s top accounting system. You can download a PDF statement as and when necessary. Read more | Payroll is responsible for processing payroll for all APS employees. Review the Payroll Summary Audit and Net Pay Comparison for a more accurate payroll process. Your dedicated support team is just a call, email, or support request away to help answer any questions. Use the analytical library of payroll tiles to make data-driven decisions about your most important asset: your people. Managers can quickly approve time cards, review employee accrual balances, and see which employees are in overtime. Read more | OnPay offers growing businesses payroll, HR, and benefits that makes their lives a lot easier. Available in 50 states, it allows employers to run payroll from anywhere, pay employees by direct deposit, debit cards or printed checks, and automate all their tax filings and payments. OnPay even handles all the setup and offers a tax accuracy guarantee. All of OnPay's services are included for a flat monthly fee of $36 plus $4 per employee. Its fee includes unlimited pay runs (and any cancellations), tax filings (including 1099s and W-2s), and best-in-class integrations with QuickBooks, Xero, and top time tracking software. and extends to payroll for organizations like nonprofits, clergy, and agricultural businesses. A full set of HR tools (including self-onboarding, offer letters, and PTO tracking) is also included. When an employer wants to offer more robust benefits, OnPay is a licensed health insurance broker in all 50 states, plus it offers 401(k) and workers' comp plans through seamless integrations. OnPay receives the highest possible ratings from the Motley Fool’s Blueprint and CPA Practice Advisor, an “Excellent” rating from PC Magazine, and the — most importantly — best customer ratings on review sites like Capterra. Read more | Remofirst understands that hiring remote employees can be costly and time consuming, that’s why we have the best pricing on the market and offer same-day onboarding. Plus, platform is available in over 150 countries, so you don’t have to worry about any legal implications.This all-in-one platform allows to hire remote employees with one click. take the hassle out of managing your international HR, so you can focus on what really matters: growing your business. This intuitive dashboard allows to access all compliance documents securely, as well as manage payroll and timesheets. With Remofirst, can hire remote employees from anywhere in the world with one click and be sure that all the legal and HR aspects are taken care of. They are the perfect platform for international companies looking to hire remote teams or individuals. Read more |

| Pricing Options |

|

|

|

|

| SW Score & Breakdown |

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

92% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

76% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| SaaSworthy Awards |

Not Available

|

Not Available

|

# 2 Highly Rated # 3 Fastest Growing |

Not Available

|

| Total Features |

10 Features

|

12 Features

|

13 Features

|

4 Features

|

| Common Features for All |

401(k) Tracking

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-country

Self Service Portal

Tax Management

W-2 Preparation

Wage Garnishment

|

401(k) Tracking

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-country

Self Service Portal

Tax Management

W-2 Preparation

Wage Garnishment

|

401(k) Tracking

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-country

Self Service Portal

Tax Management

W-2 Preparation

Wage Garnishment

|

401(k) Tracking

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-country

Self Service Portal

Tax Management

W-2 Preparation

Wage Garnishment

|

| Organization Types Supported |

|

|

|

|

| Platforms Supported |

|

|

|

|

| Modes of Support |

|

|

|

|

| API Support |

|

|

|

|

| User Rating |

|

|

|

|

| Ratings Distribution |

|

|

|

|

| Review Summary |

Not Available

|

Users generally praise the software's user-friendly interface, making it easy to navigate and understand. The payroll processing is highly accurate, ensuring timely and precise payments to employees. The software offers robust reporting features, enabling businesses to generate comprehensive payroll reports effortlessly. Additionally, the customer support team is responsive and helpful, providing prompt assistance when needed. However, some users have experienced occasional glitches and bugs that require updates. Furthermore, the onboarding process can be lengthy and complex, requiring significant time and effort. |

OnPay is praised for its user-friendly interface, intuitive design, and comprehensive support options. Reviewers highlight the software's ability to streamline payroll processes, including pay runs, tax calculations, and direct deposits. The reporting feature is well-received for its robust insights. Additionally, OnPay's customer service is lauded for its responsiveness, professionalism, and proactive approach in addressing user concerns. However, some users express dissatisfaction with the occasional technical glitches and limited customization options. |

Not Available

|

| Read All User Reviews | Read All User Reviews | Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Green (Business Plans) Free Business (Business Plans) $22.00 $22.00 per month Business Plus (Business Plans) $51.50 $51.50 per month Multiple Clients (Accountant Plans) Custom Custom (Accountant Plans) Custom |

PAYROLL Custom PAYROLL + ATTENDANCE Custom PAYROLL + HR + ATTENDANCE Custom |

OnPay $40.00 $40.00 per month |

Contractors Free Employer of record $199.00 $199.00 per month |

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

|

|

|||

| Screenshots |

+ 4 More

|

Not Available |

+ 6 More

|

Not Available |

| Videos |

|

+ 2 More

|

+ 2 More

|

Not Available |

| Company Details | Located in: Ontario, Canada | Located in: Shreveport, Louisiana | Located in: Atlanta, Georgia | Located in: San Francisco, California |

| Contact Details |

+1-647-776-7600 https://paymentevolution.com/Payroll |

Not available https://apspayroll.com/unified-solution/payroll/ |

877-328-6505 https://onpay.com/ |

Not available https://www.remofirst.com/ |

| Social Media Handles |

|

|

|

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.