|

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Quote

|

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Quote

|

Sponsored

95% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Rippling

Visit Website

|

Sponsored

96% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Deel

Visit Website

|

| Description | Paycom is a comprehensive HR and Payroll tool that allows users to transform their workplace using a single database. With the Talent Acquisition tools, users can easily find, hire, and onboard the right candidates seamlessly. The Applicant Tracking feature enables users to post to thousands of job boards at once and also filters out non-qualified applicants. It scans more than 300 million criminal records and also allows new hires to self-onboard. Through the Performance Management tool, employees can review themselves including their managers. The employers can also align the goals of employees with those of the organization. It ensures easy payroll management where employees are paid accurately and on-time, making the whole system of the organization run smoothly. The software is designed to allow managers to complete important tasks from anywhere and handle submissions, editing, and approval of working hours online. It eliminates the process of data re-entry and comes with easy customization and search options. Read more | CloudPay provides a very accurate and automated payroll solution for all types of businesses. Companies can consolidate their payroll operations and treasury services on one cloud platform across 130+ countries. The solution is accessible, adaptable, and accurate. The cloud-based tool processes all payrolls on a single automated platform. It allows businesses to gain confidence in their global payroll and remove the in-house burden of managing the complex international payroll activities. The experts ensure accurate results in every country in which the business operates, while also helping standardize processes. It’s an interactive payroll assessment to help companies take a more proactive approach to global payroll processing. It comes with a specialized RFP template to help multinational companies design a clear and effective evaluation strategy. The template is quick to use and covers essential global payroll features and functions that are easy to use. Companies can simply choose the ones they need and remove the ones they don’t require using the simple-to-use Excel spreadsheet. Read more | Rippling is an HR solution that manages businesses’ human resource, IT and operations. Rippling helps to centralize employee data and systems and automate all the manual processes involved with employee management, this helps the companies to run more efficiently. Rippling integrates with HR systems to get employees set up and prepared for work day and places. Employees can be added to mailing lists, Slack channels, Box folders, GitHub repos and various other apps. Rippling can be used to get new hire with its Automated Onboarding. Rippling also offers solutions for new hires by managing their computers, installing endpoint security software. Strong security features help to keep users’ companies protected - down to wiping and re-provisioning for new hires. For human resource, Rippling helps take care of payroll, time tracking, reports, performance management and other related issues, and for IT, it manages Cloud LDAP, Single Sign-on, computer management, to name a few. Rippling can be integrated with various business systems to ensure an organized data management system. Read more | Deel is a platform that enables businesses to make mass payments to remote team members. It also partners with labor law experts to minimize the risk of hiring employees from other nations. They offer localized sample contracts that are in accordance with the labor laws of the involved parties and also mention which documents and permits will be required for onboarding an employee from that party. The employees have access to 100+ currencies and different types of payment methods, which allows bulk payment in one go. Other features such as e-signing, tax compliance, auto-invoicing, and customer support in different languages helps to streamline the hiring process. The employees can also create a contract, sign it, invite a team member, and allow the member to review and sign it. This end-to-end solution makes it easy for businesses to hire and pay people from around the world without worrying about the legal terms, contractor agreements, and different time zones. Consolidate and streamline your international payroll operations. Deel handles compliance, tax deductions and filings wherever you have entities—all supported by our team of in-house payroll experts. Deel is the only platform that actively helps you monitor and flag the latest payroll regulatory changes—with recommended actions—before they become an issue. It’s how we keep you compliant top to bottom, from payments, taxes, benefits, and more. Read more |

| Pricing Options |

|

|

|

|

| SW Score & Breakdown |

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

95% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

96% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| SaaSworthy Awards | # 1 Most Worthy # 1 Highly Rated |

Not Available

|

# 8 Most Popular # 3 Fastest Growing | # 3 Most Worthy # 2 Fastest Growing |

| Organization Types Supported |

|

|

|

|

| Platforms Supported |

|

|

|

|

| Modes of Support |

|

|

|

|

| API Support |

|

|

|

|

| User Rating |

|

|

|

|

| Rating Distribution |

|

|

|

|

| User Sentiments |

User-friendly Interface, Comprehensive Payroll Features, Robust Reporting Capabilities, Excellent Customer Support Inconsistent Customer Support, Complicated Benefit Enrollment Process, Time Clock Issues, Difficult System Navigation |

Not Available

|

Easy To Use Interface, Extensive Integrations, Comprehensive HR Features, Efficient Payroll Processing Limited Mobile Functionality, Confusing Time Tracking, Inadequate Customer Support, Complex Implementation Process |

Easy to Use Interface, Fast Transactions, Extensive Withdrawal Options, Helpful Customer Support High Withdrawal Fees, Limited Deel Card Availability, Occasional Payment Delays, Limited Currency Conversion Options |

| Review Summary |

Overall, users praise Paycom's user-friendly interface, comprehensive features, and excellent customer support. It is lauded for its ease of use, allowing even non-technical users to navigate seamlessly. The payroll processing capabilities are highly regarded for their accuracy and efficiency. Additionally, the reporting and analytics features are deemed valuable in providing insights into employee data and making informed decisions. However, some negative feedback mentions occasional technical glitches and a need for more customization options. |

Not Available

|

Rippling is a leading HR and employee management software solution, highly praised by users for its intuitive interface, comprehensive features, and excellent customer support. Reviewers across various platforms emphasize Rippling's ease of use, even for non-technical users, and its ability to streamline HR processes, automate tasks, and improve overall efficiency. Many users appreciate its seamless integration with other business tools, enabling smooth data sharing and enhanced productivity. Rippling's robust reporting capabilities are also a highlight, allowing organizations to gain valuable insights into employee data and make informed decisions. |

Overall, users are generally satisfied with the product, praising its ease of use, time-saving capabilities, and excellent customer support. Many users highlight the platform's user-friendly interface and intuitive design, which simplifies payroll and onboarding processes. The product is also lauded for its ability to automate tasks, such as tax calculations and compliance, saving businesses valuable time and resources. Furthermore, users commend the product's customer support team for their responsiveness, helpfulness, and willingness to go the extra mile. However, some users have expressed concerns regarding the product's occasional technical glitches and limited customization options. |

| Read All User Reviews | Read All User Reviews | Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Paycom Custom |

CloudPay Custom |

Rippling $8.00 $8.00 per user / month |

Deel Contractor Management $49.00 $49.00 per month Deel EOR $599.00 $599.00 per month Deel Payroll $29.00 $29.00 per user / month Deel US Payroll $19.00 $19.00 per user / month Deel US PEO $79.00 $79.00 per user / month Deel HR Free Deel Engage $20.00 $20.00 per user / month Deel Immigration Custom |

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

|

|

|||

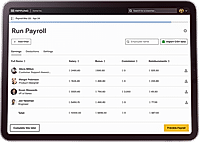

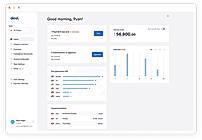

| Screenshots |

+ 3 More

|

Not Available |

+ 3 More

|

+ 1 More

|

| Videos |

+ 2 More

|

+ 1 More

|

+ 1 More

|

+ 3 More

|

| Company Details | Located in: Oklahoma City, Oklahoma - 73142 Founded in: 1998 | Located in: Andover, England - SP10 4DU Founded in: 1996 | Located in: San Francisco, California Founded in: 2016 | Located in: San Francisco, CA Founded in: 2019 |

| Contact Details |

+1 800-580-4505 https://www.paycom.com/ |

+44.1264.253.100 https://www.cloudpay.com/ |

Not available https://www.rippling.com/ |

Not available https://www.deel.com/ |

| Social Media Handles |

|

|

|

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.