LendingPad is a cloud-based loan origination software that offers a complete platform for loan origination solutions for institutions, mortgage brokers, banks, service providers, and lenders. It is specially designed to streamline the lending process, minimize mortgage lending costs, and strengthen communication. This innovatively built platform is fully secured and potently optimizes the complex loan origination process designed by mortgage banking professionals. Moreover, this software allows the user's to originate loans from anywhere with a proper internet connection. Users can incorporate with third-party data providers to manage and connect with leads promptly. This tool can gather data from retail branches, consumer online portals, call centers, and in-house loan officers. The Lender edition comprises functionalities that offer secondary, closing, underwriting post-closing, and funding. Furthermore, to enhance the connectivity and operating efficiency, a range of customization features are offered for Institutions to scale the business to the next level. With processing centers, users can equip contract processing teams to cater to more clients with extensive volumes. LendingPad follows a quotation-based and subscription-based pricing strategy that includes institution edition and broker edition.

Pricing

SW Score Breakdown

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Compliance Management

Helps in making an assessment of risks, ensures policy comprehension and that policies/procedures are being followedClient Management (Customer)

Facilitates strong necessary data about clients/customers and allows access to it when requiredCustom Workflows

Facility to create workflows with custom stages, process, and status.Free Trial

Not available

Pricing Options

Premium Plans ( Subscription / Quotation Based )

Pricing Plans

Broker Edition $40.00 $40.00 per user / month

Features

Broker Edition Custom

Features

Institutions Edition Custom

Features

Screenshots of Vendor Pricing Page

Disclaimer: The pricing details were last updated on 16/12/2020 from the vendor website and may be different from actual. Please confirm with the vendor website before purchasing.

Learn more about LendingPad Pricing.

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

85% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

84% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

80% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

77% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

80% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

85% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

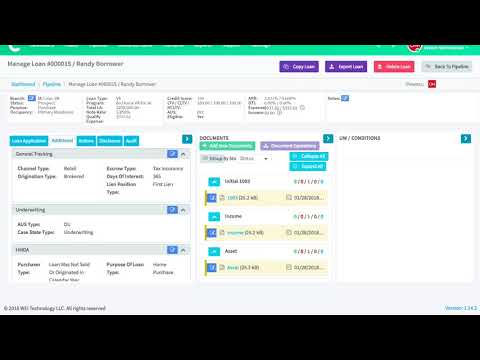

LendingPad Loan O...

How to Use Docume...

What is LendingPad used for?

LendingPad is Loan Origination Software. LendingPad offers the following functionalities:

Learn more about LendingPad features.

What are the top alternatives for LendingPad?

Here`s a list of the best alternatives for LendingPad:

Does LendingPad provide API?

Yes, LendingPad provides API.

Vendor Details

McLean, Virginia Founded : 2015Contact Details

+1 202-796-2790

https://www.lendingpad.com/

Social Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.