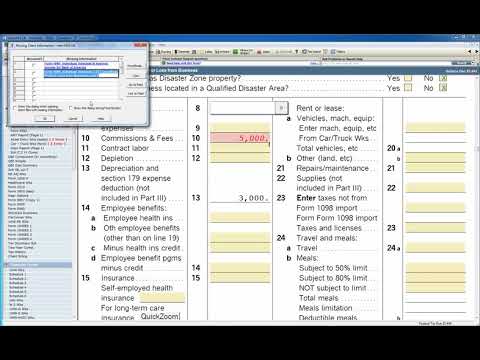

Intuit ProSeries Tax as a professional tax management software, helps users with their IT returns in a hassle-free manner. Diagnostic error-spotting technology and a friendly user interface assure on-time IT return filing. Besides getting online support while working on returns, users can seamlessly optimize the solution to find the correct field and form for tax returns. They can further take advantage of the K-1 data import option and save up to 20 minutes on every return filing. Intuit ProSeries Tax also enables its users to view, monitor and manage e-filed returns within its unified portal. They can use the worksheet embedded within the platform as a planning tool or as a checklist of completed events. Additionally, Intuit ProSeries Tax hosts a multitude of client managing modules such as checklists, billing options, client presentations, sending multiple client letters, a tax planner and an advisor offering up to 73 tax planning suggestions. A powerful dashboard, featuring e-signature facilities, helps users with authenticity management of important files.

Pricing

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Tax Management

Management of finances for payment of tax as well as assessing the advance tax liability to pay your tax in timeAudit Trail

A record of changes made in chronological order of a user or activityClient Management (Customer)

Facilitates strong necessary data about clients/customers and allows access to it when requiredTask Scheduling

Helps in scheduling various tasks for proper implementation of the sameElectronic Signature

Helps users electronically sign their digital documentsFree Trial

Available

Pricing Options

Premium Plans ( Subscription / Quotation Based )

Pricing Plans

Basic 20 (ProSeries Basic) $420.00 $420.00 per year

Features

Basic 50 (ProSeries Basic) $740.00 $740.00 per year

Features

Basic Unlimited (ProSeries Basic) $1,170.00 $1,170.00 per year

Features

Pay-Per-Return (ProSeries Professional) $300.00 $300.00 per year

Features

Choice 200 (ProSeries Professional) Custom

Features

1040 Complete (ProSeries Professional) $1,950.00 $1,950.00 per year

Features

Power Tax Library (ProSeries Professional) Custom

Features

Screenshots of Vendor Pricing Page

Disclaimer: The pricing details were last updated on 05/01/2021 from the vendor website and may be different from actual. Please confirm with the vendor website before purchasing.

Learn more about Intuit ProSeries Tax Pricing.

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read More

ProSeries Product...

ProSeries Profess...

Learn to Use ProS...

K-1 Import

Keep Records

What is Intuit ProSeries Tax used for?

Learn more about Intuit ProSeries Tax features.

Does Intuit ProSeries Tax provide API?

No, Intuit ProSeries Tax does not provide API.

Vendor Details

San Diego, CaliforniaContact Details

Not available

https://proconnect.intuit.com/proseries/

Social Media Handles

Not available

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.