| Remove All |

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Quote

|

78% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Quote

|

Sponsored

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Multiplier

Visit Website

|

Sponsored

76% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Remofirst

Visit Website

|

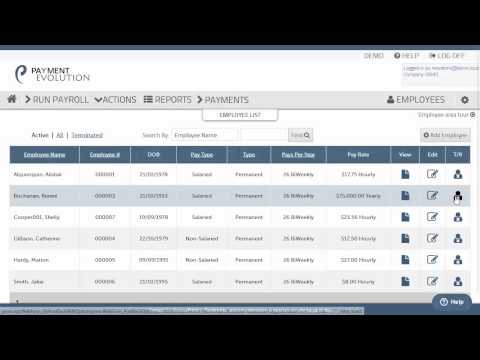

| Description | PaymentEvolution Payroll software is specially designed to cater to your employee payment needs. Custom payment rules for benefits, deductions and earnings are possible with this software. The tool always keeps the users updated with recent developments in tax tables. You can also keep employments records using PaymentEvolution Payroll software. The software is cloud based so you can access it from any web browser without any hassle. It provides detailed online payment history, and you can avail payment statement & payslips using your desktop/mobile/table. PaymentEvolution Payroll comes integrated with the world’s top accounting system. You can download a PDF statement as and when necessary. Read more | Panther is an automated global payroll and compliance for remote teams. Trusted by notable companies, this payroll and compliance platform helps them hire appropriate employees. Panther’s experts handle legal compliance worldwide. It operates across 160+ countries on behalf of several companies to acquire talents. Furthermore, Panther makes currency exchanges and global payments easy and quick. With this platform, companies get a single invoice for their entire global team. Earlier, paying globally meant getting hit with huge fees and bad exchange rates. But, with Panther, company employees get paid at the best exchange rate. For every country or state, the local laws for contractors are different. Panther, in such a situation, offers contracts that are generated locally-complaint, wherever the team is located. This platform further auto generates tax documents for each contractor. Panther makes it easy for remote teams to acquire more paychecks without jumping through hoops. Partnered with SafetyWing, this platform offers a fully-equipped health insurer, including private medical and insurance, life insurance and long-term or short-term disability. Read more | A comprehensive platform to take care of your global teams’ payroll, taxes, social contributions & local insurance policies. Enter into new markets, fast-track growth and avoid the hassle of incorporating a new entity. Get employment contracts that thoroughly comply with local laws. Onboard, pay and manage your international employees from a single platform. Read more | Remofirst understands that hiring remote employees can be costly and time consuming, that’s why we have the best pricing on the market and offer same-day onboarding. Plus, platform is available in over 150 countries, so you don’t have to worry about any legal implications.This all-in-one platform allows to hire remote employees with one click. take the hassle out of managing your international HR, so you can focus on what really matters: growing your business. This intuitive dashboard allows to access all compliance documents securely, as well as manage payroll and timesheets. With Remofirst, can hire remote employees from anywhere in the world with one click and be sure that all the legal and HR aspects are taken care of. They are the perfect platform for international companies looking to hire remote teams or individuals. Read more |

| Pricing Options |

|

|

|

|

| SW Score & Breakdown |

82% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

78% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

81% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

76% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| Total Features |

10 Features

|

8 Features

|

6 Features

|

4 Features

|

| Common Features for All |

401(k) Tracking

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-country

Self Service Portal

Tax Management

W-2 Preparation

Wage Garnishment

|

401(k) Tracking

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-country

Self Service Portal

Tax Management

W-2 Preparation

Wage Garnishment

|

401(k) Tracking

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-country

Self Service Portal

Tax Management

W-2 Preparation

Wage Garnishment

|

401(k) Tracking

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-country

Self Service Portal

Tax Management

W-2 Preparation

Wage Garnishment

|

| Organization Types Supported |

|

|

|

|

| Platforms Supported |

|

|

|

|

| Modes of Support |

|

|

|

|

| API Support |

|

|

|

|

| User Rating |

|

Not Available

|

Not Available

|

|

| Ratings Distribution |

|

Not Available

|

Not Available

|

|

| Read All User Reviews | Read All User Reviews | Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Green (Business Plans) Free Business (Business Plans) $22.00 $22.00 per month Business Plus (Business Plans) $51.50 $51.50 per month Multiple Clients (Accountant Plans) Custom Custom (Accountant Plans) Custom |

Global Employment $499.00 $599.00 per user / month Large Global Team Custom |

Hire Employees $300.00 $300.00 per month Pay Freelancers $40.00 $40.00 per month |

Contractors Free Employer of record $199.00 $199.00 per month |

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

|

|

|||

| Screenshots |

+ 4 More

|

|

Not Available | Not Available |

| Videos |

|

Not Available |

+ 1 More

|

Not Available |

| Company Details | Located in: Ontario, Canada | Located in: Tampa, Florida |

Not available |

Located in: San Francisco, California |

| Contact Details |

+1-647-776-7600 https://paymentevolution.com/Payroll |

Not available https://www.withpanther.com/ |

Not available https://www.usemultiplier.com/ |

Not available https://www.remofirst.com/ |

| Social Media Handles |

|

|

|

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.