|

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Quote

|

70% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Get Free Quote

|

Sponsored

93% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

SurePayroll

Visit Website

|

Sponsored

91% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more OnPay

Visit Website

|

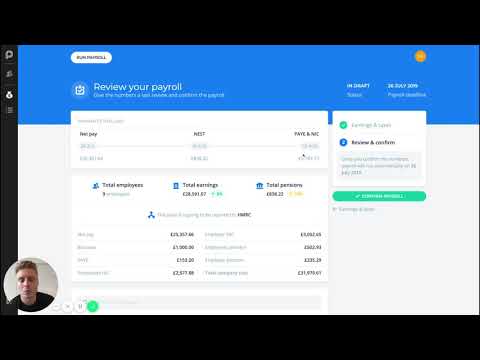

| Description | Pento is a payroll software that is cloud-based and also automates the entire process of the payroll with popular seamless integration.Run payroll confidently with a team of payroll specialists in a few minutes instead of days by automating the compliance, calculations, and payments.This payroll software has everything that you need, which includes a cloud-based intuitive software, an automatic pension enrollment. Integrations to HR and accounting tools, free and quick payroll support, automatic bank payouts, automatic pay slips distribution, and it can adjust the earnings of the employees instantly.The Pento payroll software does not require its users to have any prior knowledge of payroll, it lets you run the payroll in just a few clicks, a team of in-house experts of payroll are ready to answers all your questions if you need any help, and you no longer have to do any manual work as Pento focuses 100% on integrates with other tools and on payrolls.Now you don’t have to outsource your payroll to the payroll bureau or an accountant. Read more | Revelo payroll is a game-changing platform that transforms the way businesses pay their remote teams. Ensuring compliance with local regulations without the need to set up a local business entity, Revelo payroll gives the power to quickly and easily manage own remote payroll.Eliminate the time and hassle associated with handling payroll for remote team. Revelo payroll simplifies the process with secure database storage and access to the latest payroll features. Enjoy points-based automatic payroll that calculates the correct pay rate for each employee based on their location and wages. Additionally, Revelo payroll’s comprehensive audit reporting system shows detailed information about payroll activities, giving total visibility of entire payroll process. Read more | SurePayroll is an advanced payroll management platform that makes it simple to pay your workers, submit payroll taxes, and complete year-end paperwork easily. It provides features for small companies ranging from pay-as-you-go workers' compensation insurance to economical 401(k) plans, all with clear and reasonable pricing and customizable options to meet your requirements. Sure Payroll offers workers' compensation coverage that is simple and pay-as-you-go, along with affordable and transparent retirement and healthcare plans for small enterprises. SurePayroll's Sure401k service provides a wide range of popular and economical 401(k) plans to meet any circumstance, including regular and safe-harbor 401 plans, as well as Solo(k) plans for sole proprietorships and family enterprises. SurePayroll, in cooperation with the Paychex Insurance Agency, helps you locate top-rated health insurance coverage at an affordable price, whether you need to comply with state law, retain workers, or just provide essential health insurance for your family. You also get pre-employment screening tools and new hire reports that assist you in identifying the ideal individual. Additionally, you can pay your nanny, or other domestic workers in minutes with Sure Payroll. Read more | OnPay offers growing businesses payroll, HR, and benefits that makes their lives a lot easier. Available in 50 states, it allows employers to run payroll from anywhere, pay employees by direct deposit, debit cards or printed checks, and automate all their tax filings and payments. OnPay even handles all the setup and offers a tax accuracy guarantee. Its fee includes unlimited pay runs (and any cancellations), tax filings (including 1099s and W-2s), and best-in-class integrations with QuickBooks, Xero, and top time tracking software. and extends to payroll for organizations like nonprofits, clergy, and agricultural businesses. A full set of HR tools (including self-onboarding, offer letters, and PTO tracking) is also included. When an employer wants to offer more robust benefits, OnPay is a licensed health insurance broker in all 50 states, plus it offers 401(k) and workers' comp plans through seamless integrations. Read more |

| Pricing Options |

|

|

|

|

| SW Score & Breakdown |

86% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

70% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

93% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

91% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| SaaSworthy Awards |

Not Available

|

Not Available

|

# 2 Highly Rated # 9 Fastest Growing | # 3 Highly Rated # 9 Most Popular |

| Total Features |

15 Features

|

6 Features

|

13 Features

|

13 Features

|

| Common Features for All |

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-Currency

Self Service Portal

Tax Filing

W-2 Preparation

Wage Garnishment

|

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-Currency

Self Service Portal

Tax Filing

W-2 Preparation

Wage Garnishment

|

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-Currency

Self Service Portal

Tax Filing

W-2 Preparation

Wage Garnishment

|

Attendance Tracking

Benefits Management

Check Printing

Compensation Management

Deductions Management

Direct Deposit

Leave Tracking (Vacation)

Multi-Currency

Self Service Portal

Tax Filing

W-2 Preparation

Wage Garnishment

|

| Unique Features |

401(k) Tracking

Multi-country

Tax Management

|

401(k) Tracking

Multi-country

Tax Management

|

401(k) Tracking

Multi-country

Tax Management

|

401(k) Tracking

Multi-country

Tax Management

|

| Organization Types Supported |

|

|

|

|

| Platforms Supported |

|

|

|

|

| Modes of Support |

|

|

|

|

| User Rating |

|

Not Available

|

|

|

| Rating Distribution |

|

Not Available

|

|

|

| User Sentiments |

Not Available

|

Not Available

|

Easy to Use Interface, Excellent Customer Service, Affordable Pricing, Reliable Payroll Processing Inconsistent Tax Filing, Lengthy Customer Service Wait Times, Confusing Software Navigation, Limited Software Capability |

Excellent Customer Service, Ease of Use, Affordable Pricing, Comprehensive Payroll Features Inaccurate Payroll Processing, Delayed Customer Service Response, Lack of Automated Payroll Feature, Complicated Initial Setup |

| Review Summary |

Not Available

|

Not Available

|

Overall, users seem satisfied with the user-friendliness, customer support, and payroll processing capabilities of the software. However, there are concerns regarding its reporting features, integration options, and occasional technical glitches. Several reviewers praise the platform's ease of use, commending its intuitive interface and straightforward navigation. The responsive customer support team also receives positive feedback for their promptness and helpfulness in resolving queries. Additionally, the payroll processing functionality is generally reliable and efficient, ensuring timely and accurate payroll delivery. |

OnPay is praised for its user-friendly interface, intuitive design, and comprehensive support options. Reviewers highlight the software's ability to streamline payroll processes, including pay runs, tax calculations, and direct deposits. The reporting feature is well-received for its robust insights. Additionally, OnPay's customer service is lauded for its responsiveness, professionalism, and proactive approach in addressing user concerns. However, some users express dissatisfaction with the occasional technical glitches and limited customization options. |

| Read All User Reviews | Read All User Reviews | Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Core Custom Plus Custom Premium Custom |

Payroll Lite $50.00 $50.00 per user Payroll Pro $150.00 $150.00 per user Payroll Premium $300.00 $300.00 per user |

No Tax Filing (Small Business Payroll) $19.99 $19.99 per month Full-Service (Small Business Payroll) $29.99 $29.99 per month Household Payroll $49.99 $49.99 per month |

OnPay $40.00 $40.00 per month |

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

|

|

|||

| Screenshots |

|

Not Available |

|

+ 6 More

|

| Videos |

+ 3 More

|

Not Available |

+ 3 More

|

+ 3 More

|

| Company Details | Located in: London, United Kingdom Founded in: 2016 | Located in: Miami, Florida Founded in: 2015 | Located in: Glenview, Illinois Founded in: 2000 | Located in: Atlanta, Georgia Founded in: 2011 |

| Contact Details |

Not available https://www.pento.io/ |

+1 (786) 699-9221 https://www.revelo.com/solutions/payroll |

877-956-7873 https://www.surepayroll.com/ |

+1 877-328-6505 https://onpay.com/ |

| Social Media Handles |

|

Not available |

|

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.