|

|

85% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

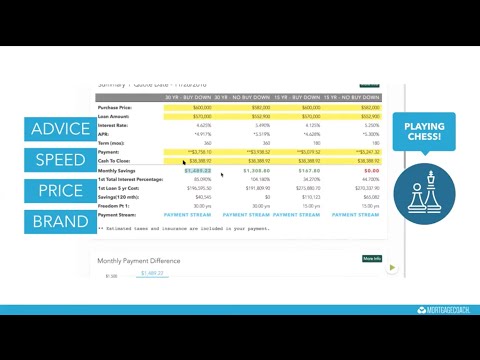

| Description | MortgageCoach help banks to turn borrower education into a competitive advantage. It comes loaded with a suite of mobile and enterprise applications capable enough to enhance the conversation between mortgage professionals, borrowers and realtors. Thus allowing them to make confident decisions accordingly. Organisations can depend on the particular software to provide clearly illustrated financial charts and mortgage options to their clients. They can also include live updates or video narration on the go, ensuring informed decision making. For companies, MortgageCoach turns out to be of great help as it provides relevant support with conversions, in recapturing pre-existing clients and in deepening realtor relationships. Regarding profitability, the software can be relied upon to reduce shopping rates, preserve margins and reduce price exceptions. For the processing part, inbuilt functionalities include workflow streamlining, real-time updates, interactive Q&A, delivery compliant services and more. Multi-channel alerts, presentation co-branding, exclusive digital experience delivery and information sharing via text/email are of great help. MortgageCoach’s inbuilt customisation facilities can be vouched upon to generate custom presentations, add personalised videos and promote individual brands. Read more | HES FinTech is a technological advisor and provider of financial software. From loan origination, underwriting, and servicing to collections and pipeline performance tracking, we offer the technical foundation for the whole loan lifecycle. We deal with custom or configured software development for banking, commercial, consumer, P2P, POS, mortgage, and microfinance lending and provide configurable Loan Origination, Loan Servicing, and Debt Collection Software. HES lending software offers a distinctive lending experience for the financial industry, enabling customers to keep up with shifting markets and client demands. It was created with flexibility and scalability in mind. To reflect the brand identity and adhere to regulatory regulations, it might be specifically designed. Proprietary loan origination software and in-house development work can both be effectively replaced by HES software. Utilize information from any credit union or bureau, databases, and other improved data sources to verify customer identities and reduce the risk of fraud. Integrate your LOS software with PEP lists, blacklists, debarred firms lists, KYC/AML systems, and more. To approve more creditworthy borrowers and lower NPLs, use AI-powered scoring software. The HES Platform can be coupled with proprietary credit scoring systems like GiniMachine or third-party solution providers like FICO, SAAS, Experian, etc. Read more |

| Pricing Options |

|

|

| SW Score & Breakdown |

85% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

83% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| Total Features |

3 Features

|

4 Features

|

| Common Features for All |

Audit Trail

Client Management (Customer)

Document Management

Mobile Access

Workflow Management

e-Signature

|

Audit Trail

Client Management (Customer)

Document Management

Mobile Access

Workflow Management

e-Signature

|

| Organization Types Supported |

|

|

| Platforms Supported |

|

|

| Modes of Support |

|

|

| User Rating |

|

|

| Rating Distribution |

|

|

| Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

MortgageCoach Custom |

HES Lending Platform Custom |

|

View Detailed Pricing

|

View Detailed Pricing

|

|

|

|

| Screenshots |

+ 1 More

|

+ 2 More

|

| Videos |

+ 2 More

|

Not Available |

| Company Details | Located in: Irvine, California | Located in: New York, New York |

| Contact Details |

(800) 951-2696 http://mortgagecoach.com/mortgage-coach |

+1 347 632 8900 https://hesfintech.com/loan-origination-software/ |

| Social Media Handles |

|

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.