|

|

77% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

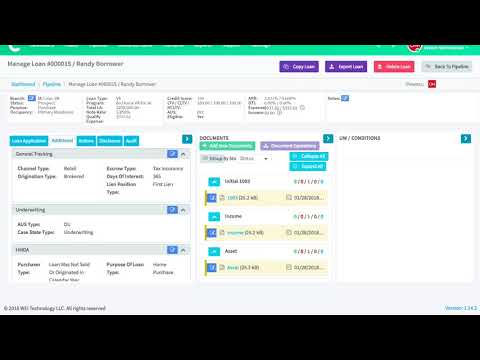

| Description | FraudGuard is a decision support platform that helps lenders to identify potential fraud risk while sanctioning loans to borrowers. The platform helps lenders to comply with regulations, find errors in mortgage applications, improve the application review process and increase loan quantity in real-time. It provides the necessary due diligence and supporting evidence to make better loan decisions. It improves risk mitigation and helps avoid defaults, foreclosures and repurchases. The platform also protects users against regulatory penalties with its up-to-date analytics. FraudGuard analyses the borrower’s income and employment through its internal and external data sources to evaluate their ability to pay. In a loan that involves property, it provides details about its value, neighbourhood analysis, property transaction history, comparables analysis, and foreclosure analysis to identify overall collateral risk. FraudGuard can be integrated with Mortgage Electronic Registration System (MERS) to identify undisclosed loans, foreclosures and pending foreclosures for the borrowers’ property. Read more | LendingPad is a cloud-based loan origination software that offers a complete platform for loan origination solutions for institutions, mortgage brokers, banks, service providers, and lenders. It is specially designed to streamline the lending process, minimize mortgage lending costs, and strengthen communication. This innovatively built platform is fully secured and potently optimizes the complex loan origination process designed by mortgage banking professionals. Moreover, this software allows the user's to originate loans from anywhere with a proper internet connection. Users can incorporate with third-party data providers to manage and connect with leads promptly. This tool can gather data from retail branches, consumer online portals, call centers, and in-house loan officers. The Lender edition comprises functionalities that offer secondary, closing, underwriting post-closing, and funding. Furthermore, to enhance the connectivity and operating efficiency, a range of customization features are offered for Institutions to scale the business to the next level. With processing centers, users can equip contract processing teams to cater to more clients with extensive volumes. LendingPad follows a quotation-based and subscription-based pricing strategy that includes institution edition and broker edition. Read more |

| Pricing Options |

|

|

| SW Score & Breakdown |

77% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| Total Features |

4 Features

|

7 Features

|

| Common Features for All |

Audit Trail

Chat (Messaging)

Client Management (Customer)

Compliance Management

Custom Workflows

Document Management

Workflow Management

e-Signature

|

Audit Trail

Chat (Messaging)

Client Management (Customer)

Compliance Management

Custom Workflows

Document Management

Workflow Management

e-Signature

|

| Organization Types Supported |

|

|

| Platforms Supported |

|

|

| Modes of Support |

|

|

| API Support |

|

|

| User Rating |

|

|

| Rating Distribution |

|

|

| Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

FraudGuard Custom |

Broker Edition $40.00 $40.00 per user / month Broker Edition Custom Institutions Edition Custom |

|

View Detailed Pricing

|

View Detailed Pricing

|

|

CloudBankin

5 Based on 81 Ratings

|

|

| Videos | Not Available |

+ 1 More

|

| Company Details | Located in: Santa Ana, California | Located in: McLean, Virginia Founded in: 2015 |

| Contact Details |

1.800.525.3633 https://www.firstam.com/mortgagesolutions/solutions/fraud-verification/fraudguard.html |

+1 202-796-2790 https://www.lendingpad.com/ |

| Social Media Handles |

Not available |

|

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.