ZenLedger is arguably the best cryptocurrency tax solutions software available to date with flexible plans which begins with a free account and other payment options. With ZenLedger, you can import all cryptocurrency data from most exchanges to autogenerate all tax forms required by the IRS. ZenLedger ensures full compatibility with most popular exchanges, including Coinbase, Bittrex, Binance, GDAX, Poloniex, and Kucoin, and many other exchanges. Also, the platform supports almost all cryptocurrencies from BTC and BCH to XRP and LTC, including fiats. With the ZenLedger import feature, you can import all transactions from any exchange wallets and use that data to create multiple valuable documents. Reports you can create with this imported data include revenue reports, final reports, and capital gains reports. Another exciting thing is that ZenLedger platform generates profits and losses that you and your CPA can use to get the right tax. Whether you are a day trader, crypto owner or miner, this platform guarantees you that you will not pay excess taxes. Also, ZenLedger is not just for Americans, it can help all customers in the world currently using a large number of accounting books and wants these separate transactions to be easily erased and summarized in more readable and standardized formats.

Read morePricing

Platforms Supported

Organization Types Supported

API Support

Modes of Support

Free Trial

Not available

Pricing Options

Freemium ( Limited Features )

Premium Plans ( Subscription )

Pricing Plans

Free Free

Features

Starter $49.00 $49.00 per year

Features

Premium $149.00 $149.00 per year

Features

NFTs and DeFi are supported with tax professional prepared plans.

Executive $399.00 $399.00 per year

Features

NFTs and DeFi are supported with tax professional prepared plans.

Platinum $999.00 $999.00 per year

Features

NFTs and DeFi are supported with tax professional prepared plans.

Screenshots of Vendor Pricing Page

Learn more about ZenLedger Pricing.

78% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

ZenLedger - The E...

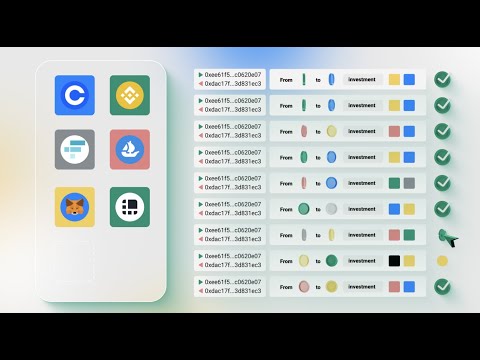

ZenLedger screenshot

Dashboard screenshot

What are the top alternatives for ZenLedger?

Here`s a list of the best alternatives for ZenLedger:

Does ZenLedger provide API?

Yes, ZenLedger provides API.

Vendor Details

Bellevue, WA Founded : 2017Contact Details

Not available

https://www.zenledger.io/

Social Media Handles

This research is curated from diverse authoritative sources; feel free to share your feedback at feedback@saasworthy.com

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.