When it comes to free accounting software, you’ll find a dozen of options. However, in a country like India, where digitization is still in its nascent stages, it’s important to think about such software differently. That’s what OkCredit did when it launched in 2017. It made it extremely easy for retailers to add information about credit and debt from their phones themselves. Today, it’s a leading player in the bookkeeping space in the subcontinent. To better understand its inception and journey, we got in touch with Mr Harsh Pokharna, co-founder and CEO.

PS: the interview has been edited for the sake of brevity.

Table of Contents

1) Can you share your journey into the startup world?

Four years back, the three of us – my co-founders Gaurav and Aditya, and I wanted to build a startup but barely had any idea on how to go about it. We went through some Y-Combinator videos which taught us that solving some of the problems we face in our day-to-day life using technology can be a great entry point towards building a startup.

So, we made a list of things that we and our friends were facing and needed to be solved. One of the things was how we missed talking to our family, due to lack of time. So, we created an app that would push a call whenever you’re free. However, it didn’t seem like a large enough problem, and we got bored in a few days. Among other things, we also considered making an app for splitting bills. But none of these were big enough problems to excite us.

2) What insights led you to launch OkCredit?

The idea to build OkCredit came out of our own experiences of buying things on credit. We used to buy grocery on credit from a nearby store, and every time we would go there to settle it, it would take a lot of time for the merchant to calculate our bill. That was because he used to keep the records in loose scraps of paper. Plus, the bill was always higher than we expected. We wanted to solve these two problems – record keeping for merchants and trust, and that’s how the OkCredit journey began.

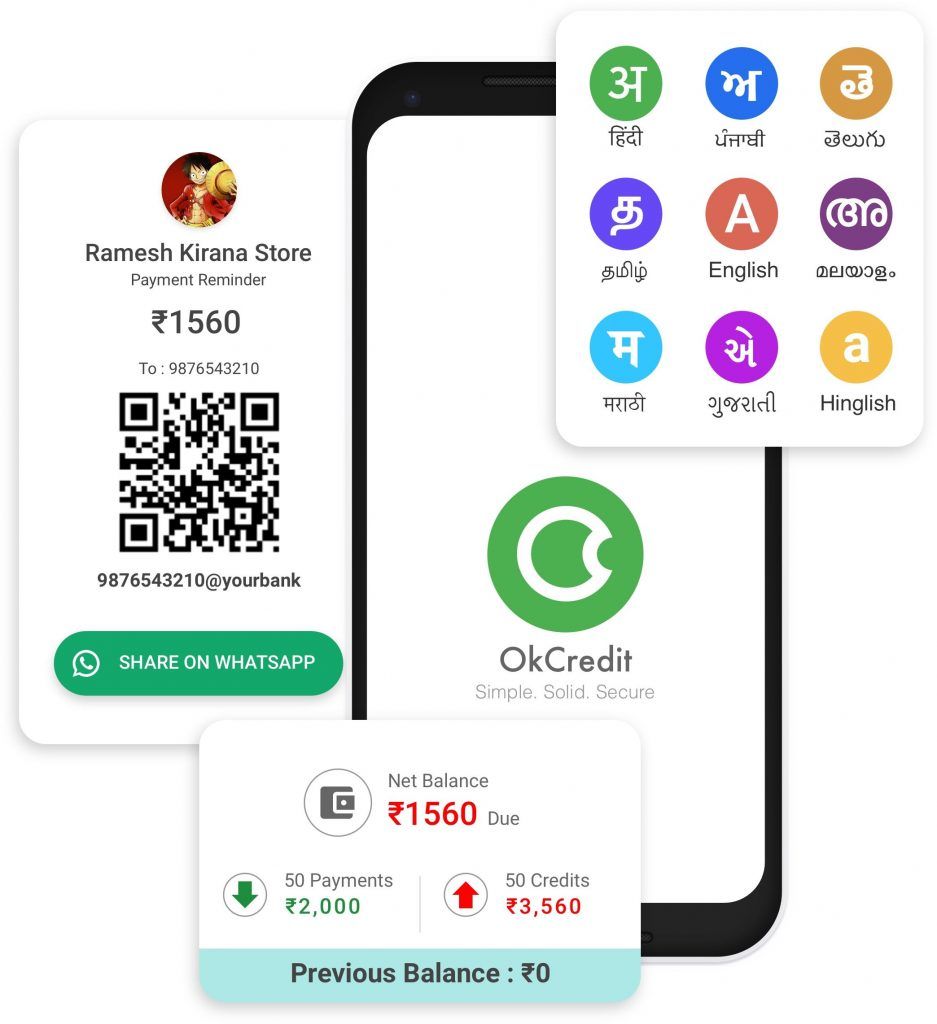

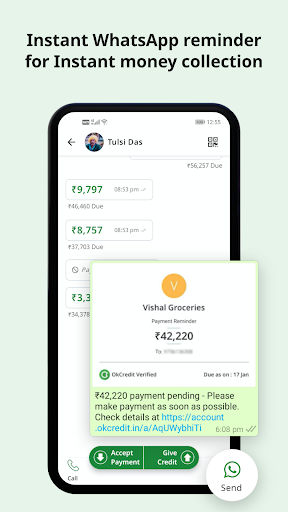

OkCredit is a mobile-based solution for small business owners and their customers. It aims to reduce the merchant’s burden of maintaining paper account books, through digitization. The app provides an on-demand visibility of credit records for merchants and enables credit payments digitally across the country. To solve the trust problem, once a merchant registers a transaction on the platform in a customer’s name, the customer is simultaneously informed through text or WhatsApp. This app also allows merchants to send collection notifications to customers in case of delayed or missed payments.

To begin with, we managed to convince the shop owner to track our payment through OkCredit. Initially, the owner had his own doubts and concerns, which we helped in solving by spending time to generate reports daily so that he could verify with this ledger book. After a few days of trial, the owner soon added a few other customers.

The next step was to convert the existing accounting system into a format compatible with OkCredit. This happened after we sat down with the owner to add all his customers and their balances to OkCredit. There was no looking back for OkCredit after that, as the store instructed its employees to use the app for all transactions.

3) Could you tell us about how OkCredit has evolved since its inception in 2017?

At OkCredit, we are focused on delivering value to customers through our proprietary digital bookkeeping solutions. We intend to expand by reaching out to small businesses that are not aware of our products and services. This is in line with our vision which is to help small businesses get the benefits of digitization.

In the first phase, to take the product beyond our first customer, we explored several markets in Bengaluru. But we were mostly targeting Kirana guys. Soon, we learned that it’s not only a problem for neighborhood grocery stores. It’s as much an issue for a mobile recharge merchant or a pharmacy. And, as we started to onboard these types of merchants, we had to make the app user-friendly for all these different categories.

The very first or second version of the app had three options – credit, payments, and return. While return happens in Kirana, it doesn’t happen in other categories. So, to make the app simpler and scalable across categories, we had to remove the return option. Though we did add an option to edit or cancel.

While we had given a call option, we thought it would make more sense to send SMS or WhatsApp alerts to customers. So, we added that. To solve for payments, we added a payment link within SMS. And thus, one feature got built on top of another. We also realized that problem was not just about selling on credit. For these merchants, buying on credit was also an issue as they needed to keep track of their purchases on credit with the suppliers. So, we built functionality for that.

Initially, the app was only available in Hindi and English. But we felt that we were missing out on vernacular users, and hence the app is now available in 11 languages.

4) Could you share how many customers do you have now?

Small merchants and retailers see OkCredit as an integral part of their business due to its best-in-class user experience. Our app has been downloaded more than 20million times to date and there are over 5.5million users who deploy OkCredit to track their account receivables and payables. These users are spread across 2,800 cities and nearby rural areas, and deal in over 100 types of businesses.

We have seen over an 800million transactions on OKCredit in 2020, amounting to $40billion worth of transactions

OkCredit has captured 0.5 percent of India’s total GDP of $2.6trillion in 2020 in terms of the total value of transactions on the platform. This was made possible through over an 800million transactions on the platform in 2020, amounting to $40billion worth of transactions. We are witnessing over three million daily transactions on the platform, and the best part is that this usage has mostly been organic. We added over 70 million new merchants in 2020.

5) Are there any specific set of shopkeepers that are using OkCredit, or it spans across all categories?

OkCredit empowers small businesses, merchants, retailers by digitizing their bookkeeping function through a simple and easy-to-access mobile app. Our users deal in over 100 types of businesses. Apart from businesses, customers are using our app to make personal transactions as well. Hence, it is a service that anyone can use, and we would not want to restrict it in any category.

6) The bookkeeping space has suddenly become quite competitive. What makes OkCredit stand out from its rivals?

Yes certainly, digital bookkeeping is a flourishing segment and has proven to have immense scope for growth in India. Talking about our brand – OkCredit – our strength lies in the robust, feature-rich product that improves the transparency in business transactions and helps in building a higher degree of trust among the participating individuals. The app is completely free to access and ensures 100% safety, data security, and accuracy. This has helped OkCredit to not only deliver better customer retention but also generate positive word of mouth through merchants who have found the platform to be simpler and easy to use leading to a strong referral-triggered growth pattern.

7) Could you shed a light on your marketing strategy?

We have maintained a razor-sharp focus on building a robust, feature-rich product that simplifies the lives of small business owners and makes them competitive. Our approach has helped us achieve better customer retention and generate organic growth without spending a lot on customer acquisition. We are also working on powerful consumer campaigns to drive demand. Our campaign ‘Taiyaar Hain Hum’ (translation: we are ready) dedicated to the local business in India showcased that OkCredit is the true companion to the local merchants and helped us onboard traditional businesses on the platform.

At OkCredit, our marketing team has played an important role in raising awareness about the brand amongst our target audience. We have spearheaded some of the significant marketing campaigns that enhanced the acceptance of digital solutions among small and medium businesses. Some of these campaigns include ‘Vocal for Local’, and ‘Chanderi ki Diwali’. Our most recent campaign on Women’s Day – #outoftheshadows was also well received. It Appeals Women to Come out of Obscurity. The campaign video highlighted the story of an exemplary woman on the OkCredit platform.

8) What’s your business model considering you offer all the features for free?

OkCredit is a free-to-use mobile app that aims to change the bookkeeping habits of India’s smallest merchants like Kirana store owners, paan shops, medical stores, and laundry service providers, among others.

As far as the revenue model is concerned, we are conducting a few monetisation experiments about which it is too early to divulge anything.

9) OkCredit has been launching other apps such as OkStaff and OkShop. What ties all of them together? More importantly, how do you focus on which one to work on?

At OkCredit, we intend to create an ecosystem of digital solutions for small businesses to help them manage their business tasks such as digital bookkeeping, staff management besides creating an online presence to compete with more organized players. Eventually, we want to be the app of choice for SMBs for all their needs.

We see the number of SMBs who will be interested in exploring digital solutions towards business objectives going up significantly in the coming years. Hence, we have scaled up from a single product company to a multi-product company solving problems for different SMB segments. We identify the unique value of network effects in this and have also started pursuing that towards delivering more value to them.

We want to be the app of choice for SMBs for all their needs.

We sincerely believe that increased investment in digital infrastructure development, smartphone penetration, and increased consumer spending will write the story of the growth of the segment in the coming decade. The fact that our digital solutions make key business tasks simpler, digitized, and secure will form the crux of increased demand for such solutions going forward.

10) How has the ongoing pandemic affected OkCredit – both in terms of businesses and no of users?

Like any other business, the digital bookkeeping segment also had to go through its ups and downs amidst the Covid pandemic. Our business dipped 26 percent, 31 percent, and 38 percent in tier 3, tier 2, and tier 1 cities respectively in April last year. However, things changed with heightened business activity among the micro, small, and medium enterprise sectors, and rapid adoption of digital business tools to drive efficiency and growth.

In the unlock phase of the Covid pandemic, our growth was particularly strong in small towns and hinterlands where OkCredit witnessed a strong recovery in demand from tier 3 cities followed by tier 2 and tier 1 cities. OkCredit app registered 33 percent growth in business from tier 3 cities in the period of February – September 2020, during which Tier 2 and Tier 1 cities registered 30 percent and 28 percent growth, respectively.

At a business category level, different magnitudes and pace of recovery have been observed by OkCredit since February 2020. We witnessed double-digit growth in business from medical and Kirana stores at 21 percent and 15 percent respectively in September 2020. This was after a dip of 12 percent in business from medical stores and 22 percent from Kirana stores in April this year.

As Covid rages on, we have doubled our efforts to create awareness about OkCredit and the convenience it brings to small businesses. We have already launched our innovative new solution called OkShop which allows small merchants to set up their online presence.

We are undertaking focused campaigns to engage business communities during this difficult period to onboard new customers, and increase usage of the app. These steps yield desired results with the micro, small, and medium enterprise sectors rapidly adopting our solutions to drive efficiency and growth.

11) What are your favorite SaaS products out there?

Slack and Shopify are some of the SaaS companies I admire. Slack for the way it has transformed team communications, and Shopify for bringing e-commerce anywhere and everywhere.