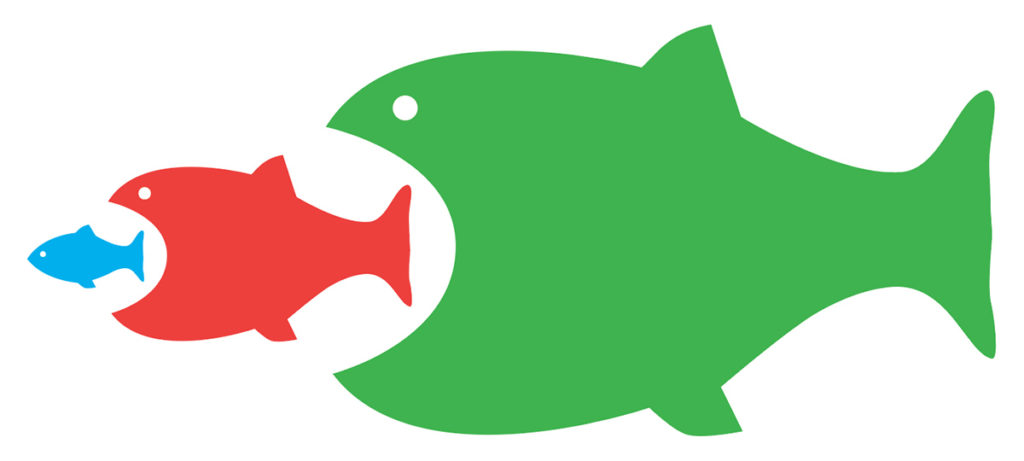

The astronomical growth of SaaS companies is responsible for the sudden transformation of the IT sector. With a complete shift to remote work in the pandemic, SaaS soared like never before. As a result, the world glimpsed some of the biggest mergers and acquisitions in the SaaS industry.

Table of Contents

SaaS Acquisitions of 2021

Here is an overview of the biggest SaaS acquisitions of the current year.

Square acquired Afterpay for $29 billion

Founded in 2009, Square is a payment fintech used by sellers for business management and audience engagement. Its Cash App is also utilized by individuals for financial investments and money storage.

Afterpay is a pioneer of the “Buy Now, Pay Later” ecosystem with a consumer and merchant tally of 16.2 million and 100,000, respectively. It has the provision of letting the user purchase products instantaneously and pay later in four interest-free EMIs.

Square took over Afterpay in an all-stock deal worth $29 billion under Scheme Implementation Deed. The final amount was calculated based on the closing common stocks of Square on July 30, 2021, conditional upon certain terms outlined by the advisors of both companies.

This acquisition has paved the way for an equitable financial ecosystem, where purchasing and selling are simplified to the minimum. Some benefits of integration of Afterpay with Square are listed below-

- Acceleration to added benefits: With a customer base of 70 million, Square offers Afterpay’s users counted benefits of Cash App’s monetary tools such as bitcoin and stock investment and purchases, money transaction, and Cash Boot.

- Incremental revenue generation prospects: Square aims to ameliorate Afterpay to reduce earnings before interest taxes depreciation and amortization(EBITDA) margins, cumulating to better profit and higher growth.

This unification of global fintech platforms is set to revolutionize the economic ecosystem across the globe.

Microsoft acquired Nuance Communication for $19.7 billion

The COVID-19 pandemic has been an icebreaker to the much-needed revolution in the healthcare industry. Identifying the urgent need, Microsoft announced its exclusive Microsoft Cloud for Healthcare to accelerate virtual patient management, teleconsultation, and diagnosis of medical diseases.

Nuance is a software company that specializes in conversational AI and ambient clinical intelligence with outstanding features like PowerScribe(Radiology transcription) and Clinical Documentation Improvement(CDI) programs for electronic healthcare records.

Microsoft acquired Nuance in an all-cash exchange valued at $19.7 billion in April 2021, amounting to $56 per Nuance’s share. The collaboration is expected to advance Microsoft’s Healthcare Total Addressable Market(TAM) TO $500 million, two-fold of the existing scenario.

This partnership is a promising development to lower the burden of the overwhelmed healthcare sector, provide speedy and cost-effective treatment with better record management and early diagnosis. It is about scaling up the cloud-based technology to heal human ailments, complying with the SDG of “Healthcare for All.”

Apart from Healthcare, Nuance also provides services such as biometric solutions, virtual assistants, and IVR. Both companies promise data security and customer compliance.

Intuit acquired MailChimp for $12 billion

In a cash and stock deal of $12 billion by Intuit, MailChimp forms the largest-ever acquisition of a bootstrapped tech firm.

Intuit is a technology platform for financial challenges that produces products for individuals, small businesses, and accountants. Some of its other remarkable acquisitions include TurboTax, Quickbooks, Mint, and Credit Karma.

On the other hand, MailChimp is a B2B agency, an email marketing company with a 73% market share in its sector. It helps small businesses achieve online visibility via smooth digital transformation, effective content creation, and automated marketing.

This deal is unique in the sense that MailChimp believes in profit-sharing bounties among its employees rather than stocks. Therefore, Intuit will be offering MailChimp’s employees $300 million in restricted stocks in the next three years.

With this acquisition, Intuit is looking forward to expanding its spectrum among medium-sized enterprises by building a resilient customer growth platform with features that optimize business management, ease cash influx, and simplify payment options.

Okta acquired Auth0 for $6.5 billion

Okta is a self-acclaimed world’s number one identity platform, also named as the Leader in the Gartner Magic Quadrant for Access Management in November 2021 for the fifth consecutive year. It acquired the authentication and authorization platform, Auth0 in March 2021 in a stock deal worth $6.5 billion, one-sixth of its market valuation of $35 billion.

By getting a cloud-identity platform on board, Okta aims to provide a secure platform to the developers and companies right from the beginning. It also offers API-based tools to the developers for innovating high-profile access controls in the applications.

Some of its remarkable products include Multi-factor authentication, Lifecycle Management, Advanced Server Access, Universal Directory, Access Management, and many others. In collaboration with Auth0, every feature receives a multi-layer augmentation with features like Machine to Machine(M2M) and Universal Authentication.

Thoma Bravo acquired Medallia for $6.4 billion

Medallia Experience Platform, a leading SaaS company in the customer experience management niche, was acquired by Thoma Bravo, the world-famous private equity firm, in a complete cash deal worth $6.4 billion.

Thoma Bravo proceeded with this acquisition to leverage proprietary Artificial Intelligence which enables businesses to calibrate their customer experience. It accomplishes this by capturing feedback by them on digital channels, social media, phone calls, Internet of Things(IoT) integrations, pushing this data into AI analytics to gather raw insights.

This deal also included the 40-day “go-shop” option where owners and advisors of Medallia were free to consider and accept other acquisition proposals. Following completion of the deal, Medallia’s common stock will be removed from the public domain.

Clearlake Capital Group acquired Cornerstone OnDemand for $5.2 billion

With headquarters in California, Clearlake Capital Group is a leading investment firm mainly focused on the industrial, technology, and consumer sector. It acquired Cornerstone OnDemand, a talent management software platform, in a cash deal of $5.2 billion at $57.50 per share.

This acquisition has been a benchmark in Cornerstone’s journey since its inception in 1999. Clearlake’s flagship program, namely OPS(Operation, People, Strategy), is expected to be supplemented with Cornerstone’s exclusive solutions like Virtual training/VILT, AI-powered HR tech, and content and skills AI.

This partnership between management and the marketing platform sets a smooth road for the growth of small, medium, and large business enterprises.

Zendesk acquired Momentive for $4 billion

The owner of the iconic SurveyMonkey platform, Momentive AI, was acquired by Zendesk, a digital customer service platform in a stock deal that included the transfer of 0.225 shares of Zendesk stock per share of Momentive stock as of October 2021.

This collaboration is envisioned to accelerate Zendesk’s revenue to $3.5 billion by 2024. Zendesk aims to build a powerful Customer Intelligence Company with the help of intuitive research-based tools of Momentum and its customer base of 20 million, further progressing to bridge the gap between customers’ expectations and seller’s products.

On transactional terms, Zendesk is entitled to 78% of the company’s shares, and Momentive takes home the remaining 22% of shares.

Bill.com acquired DivvyPay for $2.5 billion

Founded in 2006, Bill.com is a financial budgeting SaaS platform that digitizes invoicing and makes cash flow a seamless, hassle-free process. It acquired DivvyPay, an expense management software, for $2.5 billion in a dual stock($1.875 billion) and cash($625 million) deal.

The iconic merger between these platforms empowers small, medium-sized businesses by empowering the day-to-day financial difficulties faced by them. The provision of virtual cards, real-time insight into purchases and spendings, automated billing, multiple payment gateways, and a cloud-based centralized accounting system relieves the enterprises of human errors in calculation and cash management.

Bill.com is looking forward to expanding its existing customer base of 115,000 and 2.5 million networking members in collaboration with 7,500 active SMBs of Divvy.

Thomabravo acquired Talend for $2.4 billion

Established in 2008, Thomabravo is famous in the private equity sector with the acquisition of almost 325 companies worth $100 billion. It took over Talend, a data integration SaaS platform, in an all-cash deal of $2.4 billion in August 2021.

Talend helps corporates and SMBs make informed decisions with its remarkable big data solutions and products like Talend Trust Score, API integrations, and data governance. With investment from ThomaBravo, Talend will leverage the state of data, its integration, and management in a more sophisticated and healthy way.

Its products include data solutions for almost all sectors, including healthcare, finance, banking, IT, retail, and telecommunications. This partnership anticipates innovative approaches for data privacy and the development of a safe data ecosystem around cloud-based networks.

UberFreight acquired Transplace for $2.3 billion

A logistics platform, UberFreight is on its way to building the most advanced transportation platforms. Moving ahead with its vision, it acquired Transplace, the leading provider of logistics and technology solutions, in a cash and stock deal worth $2.3 billion with $750 million in the form of common stock and the remaining amount in cash.

Transplace offers technological solutions, including training and consultation for optimization of manufacturing and R&D process, capacity services like truck brokerage, and cross-border services like customs brokerage. Uber Freight envisions accelerating the logistics sectors by deploying these amazing technological solutions to reduce transportation costs and ensure last-mile connectivity.

This amelioration is expected to build a resilient one-of-its-kind shipper-to-carrier platform that will maintain a consistent supply chain and empower the logistics industry in times of crisis.

Conclusion

The acquisition is a way to growth, a road to the larger customer base, better investors in the loop, and higher technological up-gradation to the existing products and solutions. 2021 has been a phenomenal year for the SaaS industry as some historic acquisitions took place over time.