Finance planning conversations have never been more nerve-wracking as it is now. Be it individuals discussing finance with their family members, friends, or conveying and organizational financial management needs to a financial advisor.

Individuals with working financial literacy have two approaches to sort their finances. They can either go for the DIY approach, or hire a professional advisor. Considering the changing finance requirements and the government’s ever-changing tax compliance norms, a better approach is to hire a professional or use a software. Here, we have a mix of tools that personal financial advisors and enterprise firms use to help one track every penny that they have earned, and more importantly, do proper financial planning.

Table of Contents

7 top financial planning software

Personal Capital

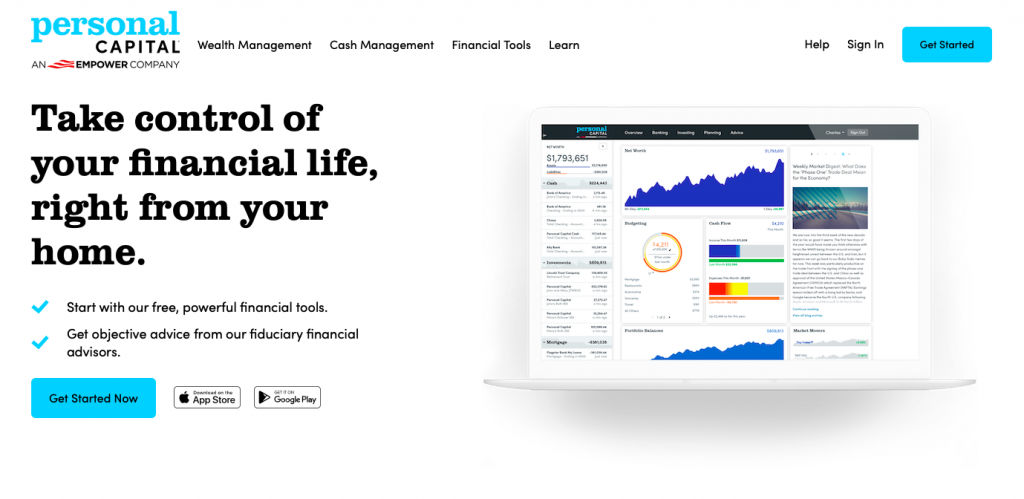

Managing different accounts can get any beginner or an intermediate level finance planner into a mess. The need for a solution that aggregates all accounts in a single view is indispensable, and this is made more accessible with few clicks leads with the use of Personal Capital.

Personal Capital finance planning software is touted as the ultimate accounts aggregator. Here, you can include multiple accounts, and track the flow of funds on the go. You can even add retirement and investment accounts. Speaking of retirement., this feature-rich software has the tool to predict the amount of savings that you need to have to retire at peace, and on time. The scope of this is not just limited to the prediction of savings, it also provides information about the over-the-top expenditure made on late fees and other defaulted financial obligations.

As part of budgeting tools, it provides information about areas where you can tighten the expenditure, and save unnecessary losses. You can track the pattern of cash outflow on various filter parameters, like date, and nature of transactions.

You can use this software on the web and mobile too. The free version has apt features to work with, while the advanced version gives you value for money.

Quicken

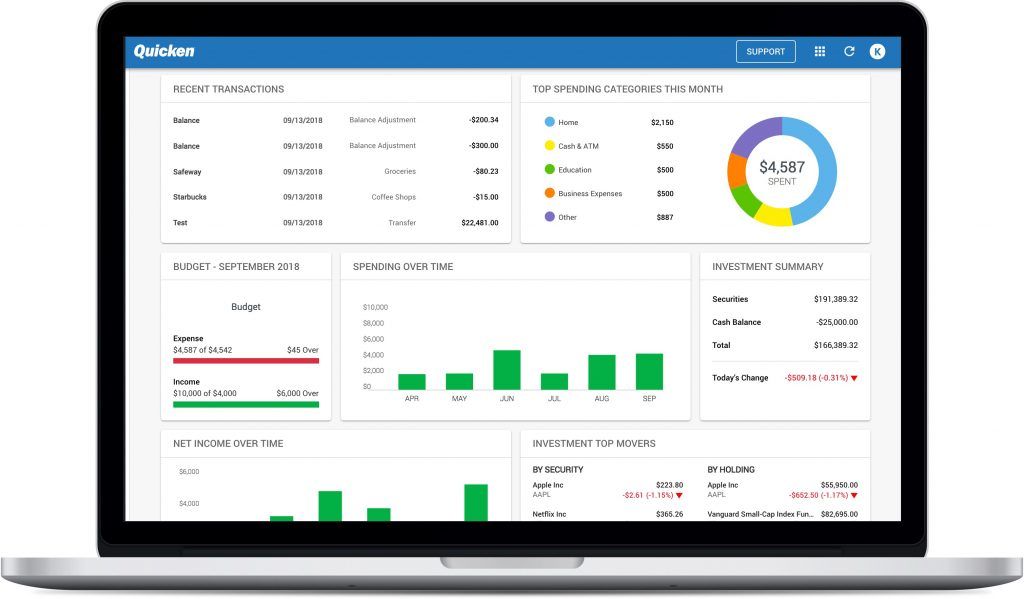

Quicken is a mix of personal and business financial planning software. It incorporates various financial planning solutions on a personal scale like planning a budget, measuring progress, and recording banking transactions, tracking investments, and their performance and prices.

Quicken provides different versions with differing costs like ‘Basic’ that includes regular activities for somebody with straightforward financial records, to private businesses who not only need a solution to sort their finances, but also acquire knowledge, and key input about financing from experts.

Quicken incorporates online services that permit clients to recover transactions from different suppliers such as their credit card company or bank. In most instances, technical support and online services are upheld for three years following the labeled version.

The price for the annual subscription plan begins at $34.99.

Intuit Mint

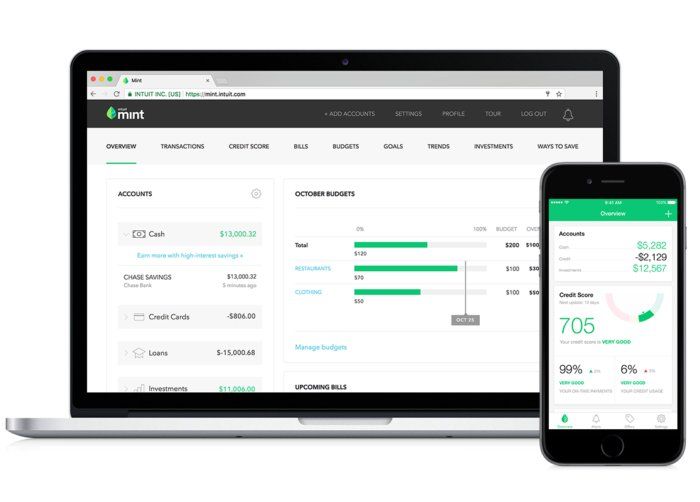

Intuit Mint finance solution is apt for solving budgeting and money management issues. It allows you to manage stress-free by managing savings, expenditures, and incomes. You can also manage your business credits and finances by using Intuit Mint. It also notifies you to pay off your business loan EMI on time. So, you can maintain a healthy credit score, which you check on the platform as many times as you want.

Since its launch in 2007, it has helped various individuals and small businesses manage their accounts, bills, credit cards, loans, etc. It has an app avatar for both Android and iOS.

In sum, Mint is a financial planner, bill tracker, and budgeting app. It also alerts you when your budgeting and planning go off-track. Businesses can take advantage of managed subscriptions and monthly bill reminders.

eMoney Advisor

eMoney Advisor is focused on delivering planning-oriented finance solutions that can drastically influence the relationship between a personal finance advisor, or an enterprise with their clientele.

eMoney Advisor has the tools to suit the requirement for both large enterprises and independent financial advisors. Its solutions work on the mobile device or desktop screens as well.

It allows the financial advisors of any nature and operational scale, to swiftly move their client from a basic approach to manage finance to handling complex ‘what-if’ scenarios using advanced financial planning solutions. For pricing details, you need to send an inquiry.

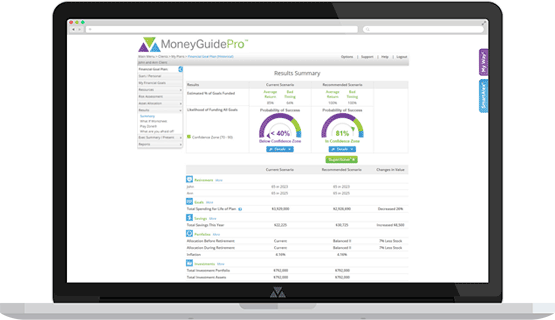

Money Guide Pro

Money Guide Pro is an ideal finance planning solution for professional financial advisors. With the software, the advisor can walk through the clients’ basic to complex financial management needs through a single platform.

It has changed the conventional perspective on financial planning with the inclusion of out-of-the-box solutions to gauge and perfect the financial plan. It comes in three different versions – One, Pro, and Elite. All these versions have a mix of features, like social security optimization, detailed plan analytics, plan summary, net worth, custom report templates, and many unmatched features. You enjoy the features which you pay for based on versions.

Considering the central life aspect, you can create plans for your savings, retirement, savings, and age in one place. Money Guide Pro will compile your transactions and objectives to give you immediate results.

RightCapital

If you are stressed about your finances, business, and retirement, RightCapital is an incredible and intuitive projection tool to make plans for retirement and the uncertain possibilities that come with it. You can also showcase to your clients how they can augment their Federal retirement-aide benefits and comprehend the effect of choices about Government health care.

RightCapital has a simple to use interface, permitting you to locally avail customers, for instance, letting them fill in their details, and have first-hand experience of the platform. With the tool, you can show your customers how to set aside some cash utilizing tax-productive techniques for appropriating their assets.

This financial planning platform gives you a user-friendly tool to manage the expenditure and outline alternatives for squaring away debt, including loans. You can also use aggregation to connect credit cards, externally held investments, and bank accounts to possess a clear financial picture. Its pricing goes from $50 to $660 per advisor per month depending upon the plan you opt for.

Advicent

Empower your financial services as an advisor to meet the clients’ requirements by using the Advicent cash flow-based approach and NaviPlan software suite. It is one of the most sophisticated finance tools out there designed for finance professionals.

Advicent is specifically designed to help you guide through every step from simple plans to complex high net worth plans. Their products are sufficient enough to satisfy the need of every kind of investor and firms of all sizes.

Conclusion

Building a comprehensive financial plan is the key in every aspect whether you do it yourself or with the help of an advisor. Fortunately, to make your work more efficient and smoother, there are several online services to help you out in making a better financial plan. So, before you move on to choose the best firm, you must jot down all your requirements and the budget for a hassle-free deal.