| Remove All |

97% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

Visit Website

|

Sponsored

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

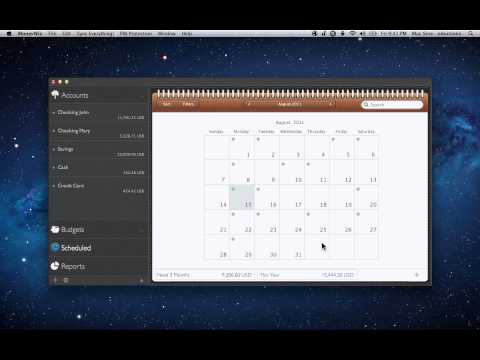

Quicken

Visit Website

|

Sponsored

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more Simplifi

Visit Website

|

| Description | Mint is a simple budget tracker and planner tool that lets users bring all their accounts, bills, and financial data in a single place to conveniently manage their finances. It is a free and easy-to-use platform that connects every US financial institution. The tool takes care of users' bank accounts, credit cards and even retirement accounts. It enables the users to view all their bills and money at a glance and create budgets easily by using the tips that it provides. Mint allows users to easily track their bill, they just need to add them to their dashboard to see and monitor them. Once added, they will receive reminders for upcoming bills so they can plan. They will also receive alerts for payments. When users' funds are low, they will receive an alert so that they can plan accordingly and spend only on essential things. The user data is kept entirely secure with multiple safety measures like secure sign-in and VeriSign security scanning. Read more | MoneyWiz is a powerful personal finance tool that helps the user keep track of their finances. It offers direct sync with more than 20,000 banks across 50 countries. MoneyWiz also works with Plaid, Yodlee, and SaltEdge as an added advantage. Its features include compact layout, easy swipe across categories, bulk edit and delete, intuitive display, smart analytics on credit utilization, and balance available. The tool offers users customizations in terms of colors and logos for each category. MoneyWiz allows users to easily modify the existing shareholding to adapt to any share split or even bonus allotments. Users can keep track of their daily and monthly spends across various categories like Fuel, Groceries, utility payments, etc. Users can also set up reminders for payments and card bills. Moneywise gives a comprehensive view of all the Banks, Credit cards, Investments, Expenditures, Wallet balances, Loans, and Receivables of the user. The tool also enables users to set up budgets and goals to meet personal finance goals. Read more | Quicken is a personal finance management tool that helps to organize and manage personal budgets. Get real-time notifications in your Quicken mobile app* when you use your card, including pending transactions, so your spending, budgets and custom alerts are always up to date. Reimbursement for expenses incurred for stolen or damaged phones, if recurring phone bill payments are made with an eligible Mastercard. Pay any bill directly from Quicken. Now Quicken Bill Pay1 is free with Premier and Home, Business & Rental Property plans. No need to go to different websites, remember passwords, and monitor multiple accounts1. Access both e-bills and manual bills on one common dashboard. They protect your data by using a secure Internet connection and the latest SSL encryption technology. Read more | Simplifi is a finance management app created by Quicken that helps individuals reach their money goals. Users can see, plan, and navigate their finances anywhere and can also customize their finance categories and tags. The app provides useful insights about everyday changes that can help users achieve their financial goal in the future. Individuals can get a consolidated snapshot of their credit cards, investments, recurring bills and subscriptions, and upcoming bills and transactions to understand how it affects their balance. They can also be in control of their spendings and manage their bills using simple graphs and personalized categories. Simplifi analyses the user’s income and bills, and creates a customized spending plan which ensures a consistently positive account balance. It also helps them to set up savings goals for different milestones, track the progress, and understand how to reach those goals. All these features make it possible for individuals to set and achieve homeownership goals, family savings goals, vacation goals, and many others. Read more |

| Pricing Options |

|

|

|

|

| SW Score & Breakdown |

97% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

87% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

98% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

89% SW Score The SW Score ranks the products within a particular category on a variety of parameters, to provide a definite ranking system. Read more

|

| SaaSworthy Awards | # 3 Most Worthy # 2 Most Popular |

Not Available

|

# 1 Most Worthy # 5 Fastest Growing |

Not Available

|

| Total Features |

12 Features

|

13 Features

|

14 Features

|

14 Features

|

| Common Features for All |

Alerts

Bills Management

Budgeting

Expense Groups

Financial Dashboard

Investment Monitoring

Loan Management

Multi-Currency

Payment Gateway

Property Management

Reports

Spend Tracker

Spending Limit

Tax Reports

Transaction History

|

Alerts

Bills Management

Budgeting

Expense Groups

Financial Dashboard

Investment Monitoring

Loan Management

Multi-Currency

Payment Gateway

Property Management

Reports

Spend Tracker

Spending Limit

Tax Reports

Transaction History

|

Alerts

Bills Management

Budgeting

Expense Groups

Financial Dashboard

Investment Monitoring

Loan Management

Multi-Currency

Payment Gateway

Property Management

Reports

Spend Tracker

Spending Limit

Tax Reports

Transaction History

|

Alerts

Bills Management

Budgeting

Expense Groups

Financial Dashboard

Investment Monitoring

Loan Management

Multi-Currency

Payment Gateway

Property Management

Reports

Spend Tracker

Spending Limit

Tax Reports

Transaction History

|

| Organization Types Supported |

|

|

|

|

| Platforms Supported |

|

|

|

|

| Modes of Support |

|

|

|

|

| API Support |

|

|

|

|

| User Rating |

|

Not Available

|

|

Not Available

|

| Ratings Distribution |

|

Not Available

|

|

Not Available

|

| Review Summary |

Not Available

|

Not Available

|

Numerous reviewers commend Quicken for its user-friendliness, robust features, and reliable performance. They appreciate its intuitive interface, extensive customization options, and insightful financial reports. The rental property management module is particularly praised for its ease of use, comprehensive features, and accurate tracking of rental income and expenses. However, some users express concerns about occasional technical glitches, a steep learning curve for some features, and limited customer support. Overall, Quicken is generally well-received for its user-friendly design, diverse features, and helpful reporting capabilities. |

Not Available

|

| Pros & Cons |

|

|

Not Available

|

Not Available

|

| Read All User Reviews | Read All User Reviews | Read All User Reviews | Read All User Reviews |

AI-Generated from the text of User Reviews

| Pricing Options |

|

|

|

|

|

Pricing Plans

Monthly Plans

Annual Plans

|

Mint Custom |

Premium $4.17 $4.99 per month Standard $19.99 $19.99 per year MoneyWiz 3 (Pay once) Others MoneyWiz 3 (subscriber) Others |

Starter (Window) $35.99 $35.99 per year Deluxe (Window) $46.79 $46.79 per year Premier (Window) $70.19 $70.19 per year Home & Business (Windlow) $93.59 $93.59 per year Starter (MAC) $35.99 $35.99 per year Deluxe (MAC) $46.79 $46.79 per year Premier (MAC) $70.19 $70.19 per year |

Simplifi $3.99 $5.99 per month |

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

View Detailed Pricing

|

|

|

|||

| Screenshots |

+ 1 More

|

+ 1 More

|

+ 2 More

|

+ 8 More

|

| Videos |

|

+ 2 More

|

+ 2 More

|

+ 2 More

|

| Company Details | Located in: Mountain View, California | Located in: San Francisco, California | Located in: Menlo Park, California Founded in: 2016 | Located in: Menlo Park, California |

| Contact Details |

Not available https://www.mint.com/ |

Not available https://wiz.money/ |

Not available https://www.quicken.com/ |

Not available https://www.quicken.com/simplifi/ |

| Social Media Handles |

|

|

|

|

What are the key differences between Mint and MoneyWiz?

What are the alternatives to Mint?

What are the alternatives to MoneyWiz?

Which product is better for tracking daily and monthly spends?

Can I set up reminders for payments and card bills in both Mint and MoneyWiz?

Looking for the right SaaS

We can help you choose the best SaaS for your specific requirements. Our in-house experts will assist you with their hand-picked recommendations.

Want more customers?

Our experts will research about your product and list it on SaaSworthy for FREE.