Salesforce – regarded as the pioneer in the software-as-a-service ecosystem – has made its biggest acquisition with Slack. The collaboration software which started as a game by Stewart Butterfield and Cal Henderson is the latest in the string of purchases the CRM leader has made. Salesforce has been leveraging acquisitions for a long time to stay ahead of the competition. While it remains to be seen how this deal will play out, let’s take a look at the top acquisitions by Salesforce.

Note: The list is in the descending order of the purchase price.

Table of Contents

Slack: $27.7billion (December 2020)

Slack single-handedly created the category by making it easier for employees to collaborate with each other and not use email for every communication. Right from messaging to the ability to attach files, and from creating channels with different people to integrating with third-party services to display the data up front, it’s quite versatile. The company was started in 2013, and IPO’ed in April 2019 with a valuation of $21billion.

It has now been purchased by Salesforce for $28billion ($27.7billion, to be exact). It’s not only the biggest acquisition by Salesforce, but also ranks number 2 as the biggest software deal of all time – right after IBM’s purchase of Red Hat for $34billion. In a press release, Salesforce states that Slack with combined with Salesforce Customer 360, and create the OS for the new way to work and enable companies to “grow and succeeded in the all-digital world“.

Tableau: $15.7billion (June 2019)

The second-biggest deal that Salesforce has ever made is for Tableau, a data visualization software. It’s evident why Salesforce made this $15.7billion acquisition – to move beyond its core capabilities by offering world-class analytics. The capabilities have already started making its way to Salesforce as Einstein Analytics has been renamed to Tableau CRM, offering AI and machine learning functionality to work with data better.

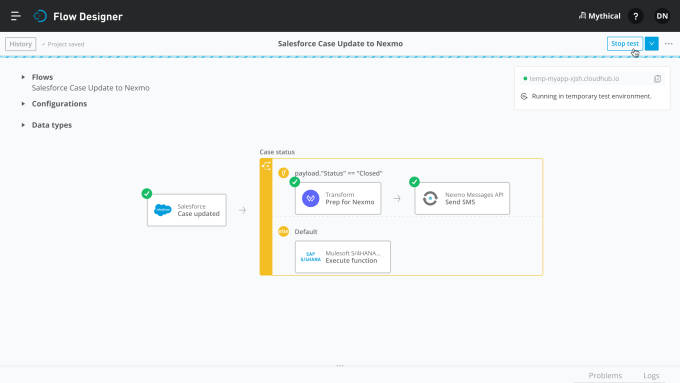

Mulesoft: $6.5billion (March 2018)

Mulesoft, started in 2006, allows organizations to build application networks via APIs. The deal made it clear that Salesforce doesn’t want to be limited to be just a CRM. It helped the company in making it easier for legacy organizations which aren’t on cloud, to be connected to Salesforce (or other SaaS products). With Mulesoft’s API, the IT infrastructure of these organizations was able to connect with Salesforce. It’s already started playing out… dubbed as MuleSoft Anypoint Platform, it lets a business create a scalable, connected experience.

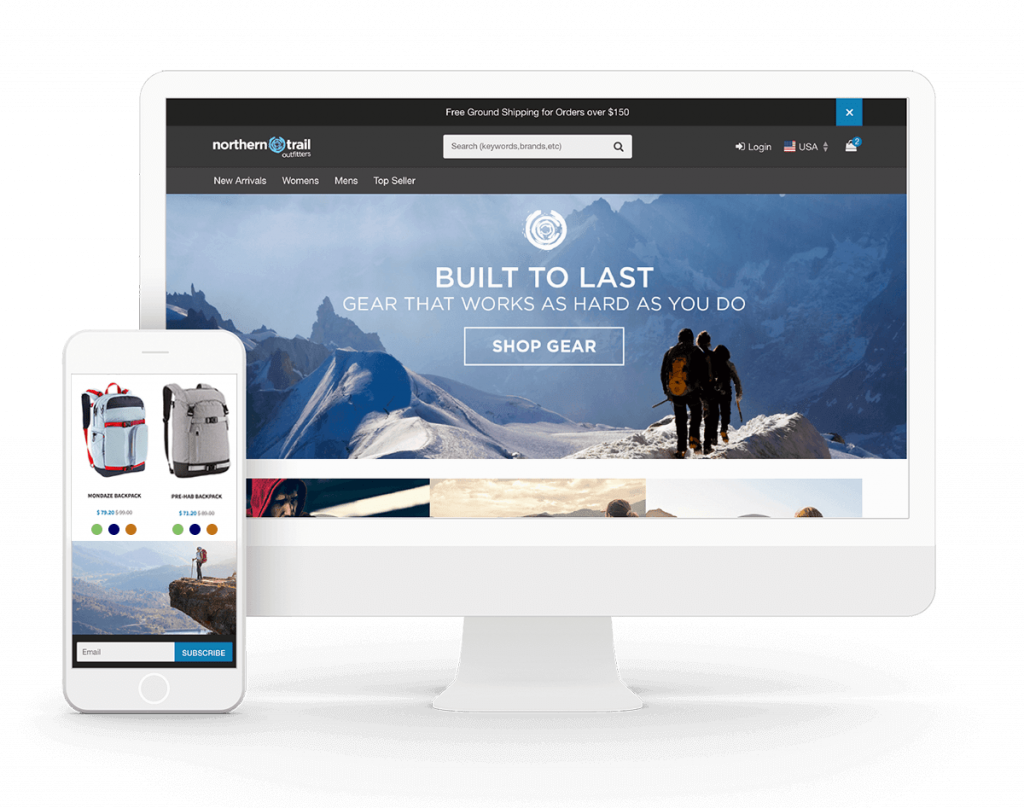

Demandware: $2.8billion (June 2016)

This acquisition helped Salesforce venture into the e-commerce territory, as Demandware provided e-commerce services to businesses. The company also created a new division to show how serious was it for the vertical, christened Salesforce Commerce Cloud. This allowed it to offer an “omnichannel commerce” to retailers, connecting all engagement channels such as web, social media, mobile, retail store, and more together. It also meant that all processes, be it marketing, order fulfilment or customer service could be handled by Commerce Cloud.

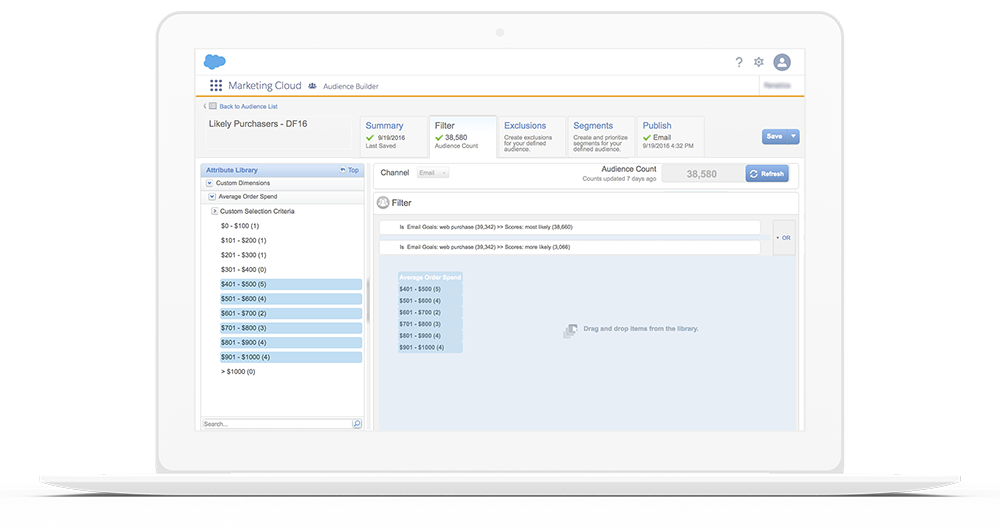

ExactTarget: $2.5billion (June 2013)

At this point, it was becoming apparent that Salesforce acquisitions help it to expand to newer markets. ExactTarget’s acquisition was no different, as it provided email marketing software. The buyout was also important for another reason – it was the first billion-dollar acquisition by Salesforce. With the deal, Salesforce introduced the Marketing Cloud which offers marketing automation by combining all channels at one place – email, SMS, social, digital advertising, and more.

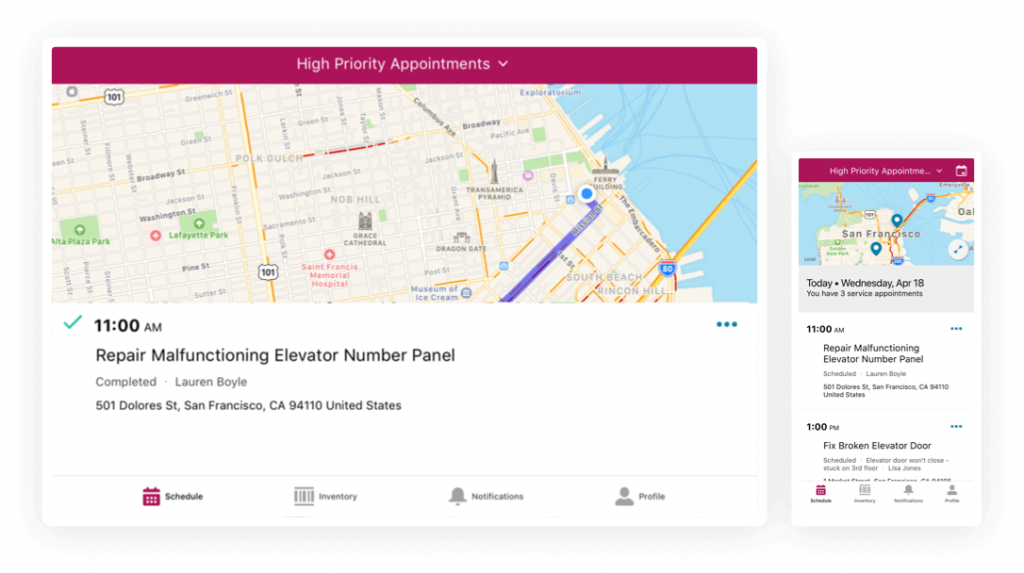

ClickSoftware: $1.35billion (August 2019)

ClickSoftware has been in the field service segment since 1997, and helps companies improve the efficiency and effectiveness of field service organizations. The team already was helping Salesforce develop Field Service Lighting (FSL) product. And hence the acquisition didn’t raise many eyebrows, except for the fact that it came soon after the company purchased Tableau.

Vlocity: $1.33billion (February 2020)

Salesforce’s CRM software is aimed at all kinds of businesses, but doesn’t specifically offer features pertaining to a specific vertical. To change that, the company purchased Vlocity earlier this year. Vlocity had created several CRMs based upon Salesforce focused on different verticals such as communications, media and entertainment, health, and more. The Marc Benioff-lead company has already started offering specific CRMs to businesses to strengthen its market share.

Quip: $750million (August 2016)

Dubbed as a living document platform, Quip combines docs, spreadsheets and more to help teams communicate and collaborate effectively. It helped Salesforce in offering bi-directional sync between CRM data and documents and spreadsheets. It also introduced ‘Live Apps’ for better collaboration on calendars, videos, images, etc. It also connected with other Salesforce’s offerings, such as Social Studio, to help create a social posting schedule among other things.

By no means, this is an extensive list. However, these are the biggest deals that Salesforce has made over the years. You can notice the trend that Salesforce has used acquisitions quite effectively to grow inorganically – either foraying into the new vertical or strengthening its core proposition, ensuring that it continues to be the leader.