Much has been written about COVID-19 hurting economic growth, plunging businesses into losses, and the long road to recovery. Amidst all the gloom, some sectors have flourished and achieved astounding growth. The rise of e-commerce, healthcare, and online education hasn’t gone unnoticed. However, the role of the enabler, SaaS, hasn’t been as widely discussed. In this article, we focus on the adoption of SaaS and how COVID helped it.

Table of Contents

What made accelerated adoption of SaaS possible in 2020?

Druva, a Pune and California-based cloud data protection startup, experienced a 70 percent year-over-year increase in recurring revenue for its data center workload protection solution. It also registered a 50 percent growth in overall data under management, according to its CEO, Milind Borate. Given the lockdown restrictions, enterprises find it difficult to manage their data center without reaching it. Switching to services like Druva helps them focus on their core business. Druva takes care of capacity planning, hardware, and software management. It also saves up to 50 percent of their costs.

Restricted mobility and work from home have popularized the SaaS applications in other ways too.

While remote workforce management and collaboration have made businesses realize the value of investing in SaaS, online education and healthcare have taken it to the end-users. A Gartner report states that SaaS is forecast to grow to $117.7billion in 2021, while the overall worldwide public cloud end-user spending to grow 18 percent in the same year.

Therefore, restricted mobility, business continuity, and better cost efficiency together have accelerated SaaS adoption.

Which SaaS companies have benefited the most in 2020?

With firms shifting to remote working, they are moving from on-premise licensed software to subscription-based SaaS models. SaaS companies that have been able to capitalize on this new demand have three things in common:

1) They support the seamless transformation to cloud

2) They are cost-effective, without compromising on security

3) They are agile to cater to changing workload by deploying and scaling a wide variety of apps

These fall into three major categories:

1. Remote workplace management

Collaboration tools like Slack, Teams, and companies like Zoho Corp. seem to have benefited the most. Slack’s $28billion acquisition by Salesforce, in some way, is a testimony to this fact.

Zoho Corp, on the other hand, expects to realize a 25 percent growth over its 400,000 customers worldwide.

The adoption rate of video conferencing software like Zoom skyrocketed through the COVID period. In Q3 its customer base with more than 10 employees grew 485% year-over-year. Its quarterly revenue at $777 million is a 500% growth from FY2019 revenue.

Microsoft Teams also registered a prolific growth over the last few months – from 44million daily active users mid-March to 115million at the end of October 2020.

Related read: The rise and rise of video conferencing apps

2. Supply chain management

The other set of SaaS businesses that COVID favored are those supporting delivery businesses. Supply chain SaaS companies have seen massive growth, as the pandemic increased pressure on the backend technology and operations of several ecommerce businesses.

Logistics intelligence platform, ClickPost registered a 3x higher month-on-month growth compared to the last year. It helps ecommerce companies select the right courier partner, generate labels, and track shipments. Notably, COVID also helped turn it profitable faster with 10million shipments a month, which is 600 percent YoY growth.

3. Essential Services: Education and healthcare

One sector that has made a lot of noise and astronomical gains during the COVID months is online education. According to a report, the global online education market is projected to grow at 9.23 percent from 2020 to 2025 – increasing from $187billion in 2019 to $319billion in 2025.

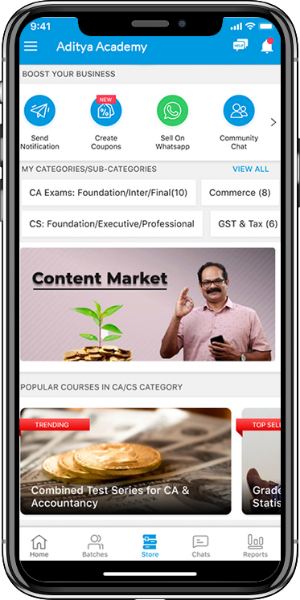

Classplus, a technology platform for educators to reach out to students has reportedly grown 10x since the beginning of 2020. In his statement to a financial daily, Mukul Rastogi, its co-founder, said that the user base and transactions also grew six and four times, respectively.

On the healthcare front, the highlight of the year has to be the launch of Microsoft Cloud for Healthcare. It aims at improving patient engagement, clinical and operational insights with better collaboration between health teams. It pieces together different parts of healthcare starting from video consultations to EHRs. In the process, it takes away a pie from Zoom, a popular application used for remote consultations.

Major highlights of SaaS in 2020

Contrary to the slowdown experienced in other sectors, SaaS was abuzz with acquisitions, IPOs, and wild upswings of few stocks along with significant funding announcements.

With a growing customer base, the valuations too increased. The time was ripe for realizing the value. Some went public, others got acquired. While the trend of SaaS companies going public continued from last year, 2020 saw some big names like Asana, JFrog, Palantir, Snowflake, ZoomInfo being listed. In fact, Snowflake was the biggest tech IPO of the year with shares ending 111 percent higher on the first day of trade. Many other SaaS companies that IPOed this year saw their stock prices surge.

The year also saw a lot of funding announcements with wild valuations for SaaS companies. Be it Notion and Figma which are being valued at $2billion, or leading RPA (Robotic Process Automation) company UiPath, which is a decacorn now. We saw a lot of new companies reaching the much-vaunted unicorn status as well, including the likes of Zenoti.

Related read: SaaS companies that got the funding in 2020

2020 was also a year of SaaS acquisitions

While the Slack acquisition stole the limelight for multiple reasons, many other deals were closed as the world grappled with the lockdown. Here are a few notable ones:

1. Dec 2020: Vista Equity Partner’s acquisition of Pluralsight for $3.5bn deserves special mention among others, as it marks EdTech’s coming of age. COVID became the tipping point for the sector, which would have otherwise taken a few more years to mature and become more mainstream.

2. Nov 2020: Gainsight, a customer success SaaS startup, is another company in which Vista Equity Partners acquired a majority stake, valuing the business at $1.1billion.

3. Oct 2020: Another deal focused on better customer engagement was Twilio’s $3.2billion acquisition of Segment, a customer data platform. Twilio, a leading cloud communication platform aims to tear down the siloes between data and communication, which prove detrimental to great customer relationships and experience.

4. July 2020: Mindville got acquired by Atlassian for its asset tracking and configuration management capabilities. It will help Atlassian further strengthen IT service management capabilities.

5. Jun 2020: ServiceNow, a digital workflow company, acquired Sweagle, a configuration data management company.

6. May 2020: Zoom acquired Keybase for its end-to-end encryption expertise, which became necessary as the pandemic-rush exposed its vulnerabilities.

7. Feb 2020: Freshworks acquired AnsweriQ, a chatbot software to improve its AI engine, Freddy.

Related read: Top 8 Salesforce acquisitions: a list of companies acquired by the SaaS pioneer over the years

What do the developments in 2020 point at for the SaaS industry?

1) With opportunity so large, many players are popping up with workable solutions. While not-so-good ones will perish, the market will still be filled with fragmented standalone solutions. Such fragmented solutions, if anything, will compound the remote working challenge. Customers cannot buy and maintain a separate solution for each of the business functions.

2) As remote working becomes the norm, the need for a unified software to manage the entire workflow will be felt. Consolidation is inevitable. Slack’s acquisition and launch of Microsoft Cloud for Healthcare are steps in that direction.

3) The other major highlight of the year was the consumerization of SaaS. With people stuck at home, SaaS kept the world connected and running. Education, healthcare, and everyday life applications made a few SaaS platforms sticky with end-users. Notion and Zoom are two names equally popular among consumers and corporates.

4) India is becoming a heavyweight in the SaaS industry. While Zoho and Freshworks continued to be the storied companies of the last decade, we’re seeing new-age companies such as API management software Postman, automated testing software LambdaTest, and more.

5) We’re also seeing the rise of the no-code and low-code software that makes it easy for anyone to create websites, apps, and more without having much coding knowledge. So, it’s not a surprise that companies like Airtable and Unqork closing the funding round this year.

6) COVID-19 has catalyzed a transformation that would have otherwise taken a few more years. Consequently, the next wave of consumer-oriented SaaS products will emerge. More fragmentation and consolidation will follow.

Which trend for SaaS in 2020 caught you by surprise? Let us know in the comment below.