Bookkeeping or accounting isn’t an easy thing, but most small store owners do it on a piece of paper. And as you could guess, it leads to a lot of issues – not only in terms of tallying the correct numbers, but also for following up for payments from vendors, customers, and more. While there are a ton of accounting software available out there, we’re seeing a rise of mobile-first software that are easy-to-use and intuitive at the same time. FloBiz is no different with its product dubbed myBillBook. In today’s SaaS Talks, we chat with its founder and CEO Rahul Raj about the startup’s inception, journey, and the way forward.

PS: the interview has been edited for the sake of brevity.

Table of Contents

1. Before we talk about FloBiz, could you share your journey into the world of SaaS?

As technologists and graduates from top-tier engineering universities, we come from a product-first approach to everything. We have been using several SaaS products for both personal and professional use. We have been witnessing remarkable technological developments across several product categories in the last decade, and we fundamentally believe that SaaS will power the evolution of consumer behaviors, expectations, and interactions with digital interfaces in the coming decades.

2. What gaps did you see in the market before launching FloBiz?

More than 60 million SMBs in India contribute to nearly 30 percent of the country’s GDP. Unfortunately, 80 percent of these SMBs still rely on pen and paper to conduct their business operations. The lack of streamlined processes, non-automation, suboptimal cash flows, and massive compliance overhead adds to the pain points of operating a business in India. We also realized that there was no dedicated software in this sector that would cater to the business owners’ needs before myBillBook – the flagship product of FloBiz. The traditional business methods consume time, create reconciliation errors, affect strategic business decisions, and fade business performance for owners.

Moreover, this lack of digitization and improper data records also result in a huge and widening credit gap for SMBs. We are confident that with the infusion of technology, we will be able to serve curated and personalized financial services to our SMB partners to enable their growth.

3. Could you share how FloBiz has evolved since its inception in 2019?

Since its inception in 2019, FloBiz has grown from 35 people to a 100-member team. Our belief and dedication to the mission of accelerating the growth of SMBs through digitization, and technology continue to grow stronger every day. We have constantly been working on simplifying business processes for SMBs with several iterations on the features and offerings in the myBillBook App. Also, the product witnessed tremendous growth from a few hundred users to over a million monthly active users in a span of just 18 months.

4. How many customers do you have now?

Despite the economic slowdown in the past 1.5 years, myBillBook has already been downloaded by over 5 million SMBs. We currently have over a million monthly active users on the product who record more than USD 1 billion worth of transactions each month. We also pride in consistently being one of the highest-rated apps in the business category on the Google Play Store.

5. How does FloBiz stand out from the competition, especially when a lot of players are providing their offerings free of charge?

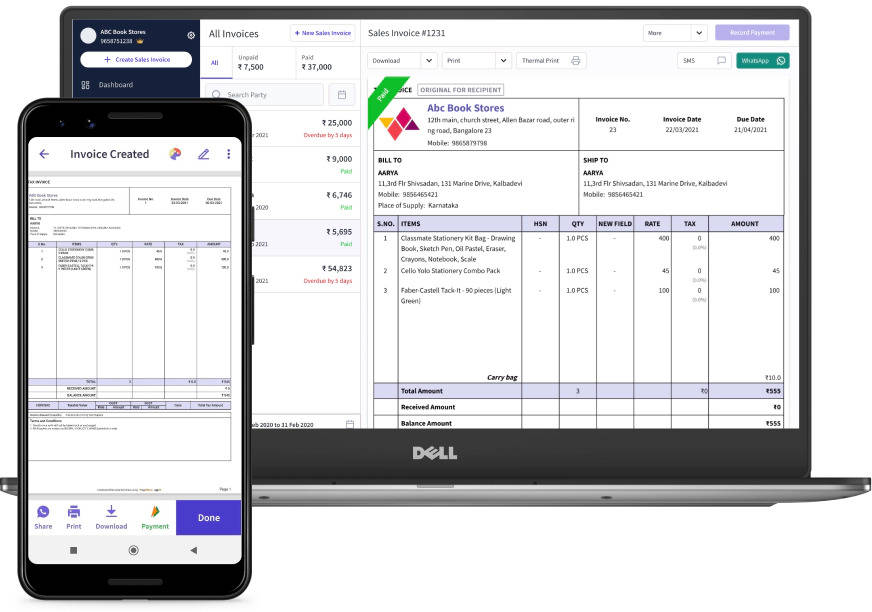

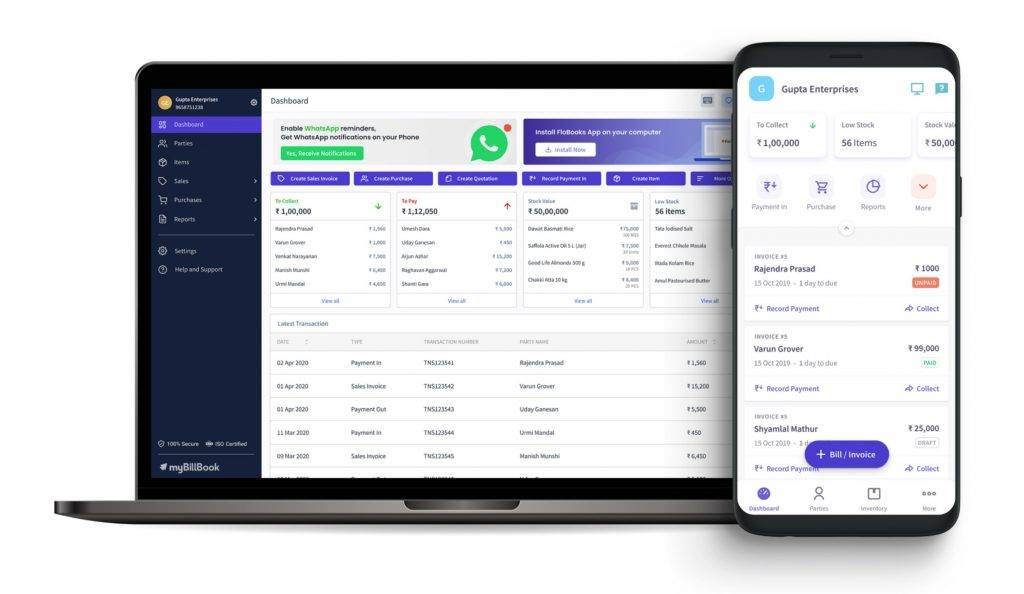

We, at FloBiz, are striving to provide the highest quality product and service to our SMB partners. We take pride in serving the largest contributors of the economy, SMBs, by building cutting-edge solutions at affordable prices. Our product, myBillBook, has been designed from first principles to simplify invoicing and accounting for business owners. As compared to other products available in the market, the business owners need no prior accounting knowledge and technical know-how to operate myBillBook. They don’t have to juggle between files, transaction books, or business records to find information about their business

The product has been designed to help SMBs run their business operations from anywhere and anytime. It is currently available in English, Hindi, Gujarati, and Tamil. It is an ideal software for business owners to create bills (GST and non-GST), record purchases and expenses, maintain stock, and manage payables/ receivables directly from their mobile phones or computers. Unlike our competition, we offer 24 x 7 customer support to our SMB partners for their troubleshooting/issues in all regional languages. Moreover, the product packages are available at very affordable prices as compared to the competition product packages. Our happy customers have constantly motivated us via emails, app reviews, and chat support to keep building robust and scalable features and capabilities within stipulated / promised timeframes.

6. Could you shed a light on your marketing strategy?

Our marketing approach has been quite simple – know the audience and understand their pain points. Once we have done that, we build the features that will impact the largest user subset.

We ensure that we highlight this iterative and experimentative approach through multiple channels like social, digital, and offline. We also focus on enhancing the user experience for both free and paid users and working through the funnels to improve conversions.

7. How has the ongoing pandemic affected FloBiz – both in terms of users of your software and the business itself?

The appetite to go digital among SMBs has rapidly grown in the last couple of years, further fueled by the pandemic. Because of our product offerings, capabilities, and features, we have also witnessed a tremendous rise in adoption in the last 1.5 years. As a company, we are focusing on expanding our user base and increasing revenue streams this year. We are glad to have a team of such talented and energetic professionals who constantly strive to leave an impact behind. Despite the fully remote work setup, we continue to deliver value and solve the most pressing pain points for Indian SMBs.

8. Any new things that you are working on? Or any acquisition on the cards to grow faster?

We’re currently working on several new initiatives such as a full suite of payments and auto reconciliation. In addition, we have a slew of developments in the pipeline for the next 12 months to simplify the lives of our SMB partners further. To name some – building industry-specific product modules and features on the product that can add value to SMB owners, preparing to roll out financial services, etc.

We plan to introduce at least 5 more regional languages on myBillBook in the coming 6 months. We are also planning to create education and awareness content for our SMB partners and enlighten them with the necessity of digitization in their day-to-day operations. Our other stealth mode work-in-progress projects will delight our valued SMB partners in the coming months.

9. What are your favorite SaaS software out there?

I have got a lot of favorite SaaS software, be it collaboration software like Slack and Discord, or video conferencing software Zoom which became the de facto way of staying connected with the team as well as friends and family. I also love Trello for project management. Graphic design software like Canva and UX design software Figma has democratized the ability to create graphics. Last but not the least, I love how marketing becomes effortless with software like HubSpot, and MailChimp.