Sridhar Vembu of Zoho and Girish Mathrubootham of Freshworks are two names that invariably pop up in every discussion concerning the Indian SaaS ecosystem. And for a good reason. Both these companies mark significant milestones in the evolution of the Indian SaaS industry. Today, we’ve many more companies from the subcontinent that are part of the exclusive unicorn club. But along with that, let’s discuss how the ecosystem has matured over the years.

Zoho and Freshworks set off a revolution of India-born, world-facing SaaS startups. (Okay, you can call it US-facing) Regardless of who the customers were, these companies built great products that created a market for themselves and others. Remarkably, bootstrapped for a long time, Zoho relied solely on the product strength to gain customers, with little marketing support. As Vembu once put it, “Engineer a good product, and customers will spread the word.”

Table of Contents

The starting point of the Indian SaaS Ecosystem

The software and IT services export laid the foundation of the Indian SaaS ecosystem. It provided a better understanding of the needs of the international market. Other factors that made the environment conducive for SaaS companies are:

1. Low personnel costs – Salaries for entry-level developers and sales personnel are 85 percent and 74 percent lower than in the US

2. Availability of talent – More than 100,000 SaaS developers

3. Effective customer service – Thanks to the IT and BPO industries, India had trained customer service workers

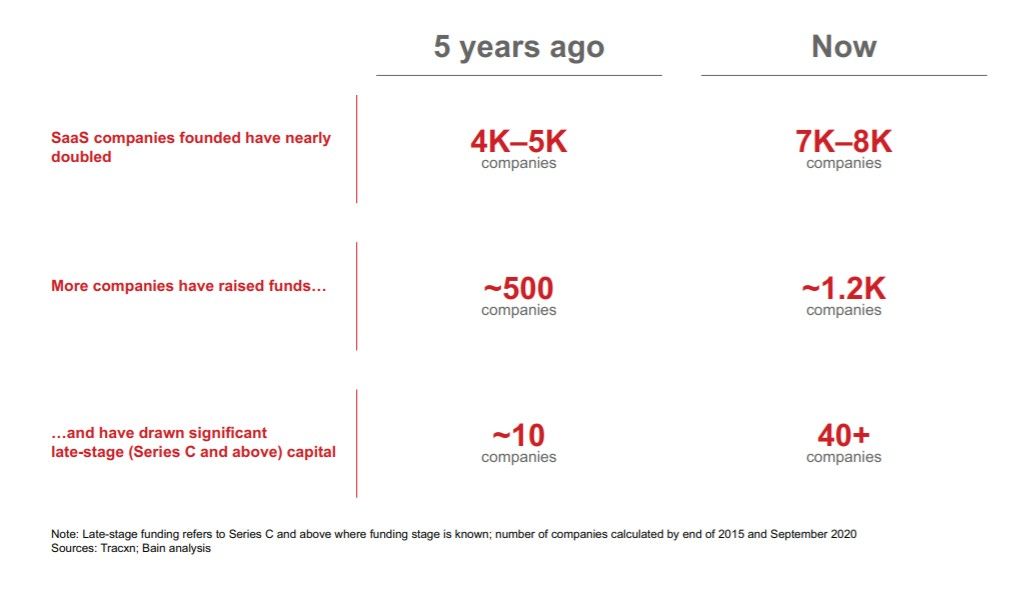

All of this reflects in the growth in the number of SaaS companies over the past five years. The number of funded companies has doubled, whereas Series C or later stages have quadrupled.

One would expect more CRM or workflow automation products after Vembu and Mathrubootham’s spectacular success. But that isn’t the case. Interestingly, all of these companies cater to different domains.

The Indian SaaS unicorns

Transitioning from IT services to SaaS products, the Indian startup ecosystem now has eight unicorns – companies with more than a billion-dollar valuation.

1. Zoho – (bootstrapped)

Bootstrapped, organic growth (barring a few minor acquisitions), likes to be called a platform and not software – that’s Zoho for you. Built on strong business foundations, it is one of the shining examples of the Indian SaaS ecosystem.

Founded in 1996 as AdventNet, it launched Zoho CRM as a product in 2005. It reached the 1-million-customers milestone in 2008. A year later, in 2009, it was rebranded as Zoho CRM.

Fast forward to 2021, Zoho is planning to take on Whatsapp with Arattai, which is a repurposed version of its enterprise messaging platform Cliq.

2. July 2018 – Freshworks – $3.5billion

Freshworks, started in 2010 by ex-employees of Zoho, Girish, and Shan, operates in a similar space as Zoho – a host of CRM, collaboration, and business solutions for enterprises.

But unlike Zoho, it has been using fundraising to catapult its growth since its inception. Freshworks joined the Unicorn club in July 2018 by raising $100mn in its seventh round.

Notably, Zoho and Freshworks are involved in a legal tussle now, with the former alleging that the latter stole IP and business data from it to build a business.

3. June 2019 – Druva – $1billion

Druva was founded in 2008 by Milind Borate and Jaspreet Singh in Pune as a startup that provided solutions for data protection and management of laptops. It moved its solutions to the cloud and became a SaaS company. In 2010, it secured its Series A, and in 2019, it raised $130mn in series E.

With offices in Sunnyvale, Singapore, and Pune, Druva has used acquisitions and partnerships to power itself to the next growth stage.

In 2020, it acquired sfApex, a leading Salesforce data migration service provider, to bolster data protection and governance. It also launched the industry’s first SaaS-based data protection for Kubernetes.

4. July 2019 – Icertis – $1billion

Icertis is a contract management platform used by several blue-chip companies around the world.

With 5.7million contracts, 2million-plus subscribers, and over $1trillion in value of contracts – it raised $115mn in Series E in July 2019. The funding made it a leading provider of contract lifecycle management (CLM) space.

The pandemic accelerated its growth. Icertis took CLM to a large number of mid-market companies. Also, it recently announced a tie-up with SAP Sales Cloud to Reduce Sales Cycle Times.

5. January 2020 – HighRadius – $1billion

A fintech SaaS company that leverages AI to automate accounts receivable and treasury processes, HighRadius, was the first unicorn of 2020.

HighRadius, founded in 2006 by Sashi Narahari, was bootstrapped until 2017. It raised $125 million in series B when it had around 400 clients across the globe.

With offices in Amsterdam, Frankfurt, Houston, and Hyderabad, it is now eyeing global expansion. It’s also actively accelerating its platform development targeting new user segments in banks and mid-sized businesses.

6. June 2020 – Postman – $2billion

Postman, an API management platform, took the shortest time to turn a unicorn. After six years of being founded, it hit a $2bn valuation in its series C of $150mn in June 2020.

It makes creating, sharing, testing, and documenting APIs easy. It also helps developers monitor the performance of the API at scheduled intervals.

7. October 2020 – RazorPay – $1billion

RazorPay automates payment acceptance from customers and payouts to vendors/employees. It started with a mission to find the right payment solutions for small firms that used a fragmented and less efficient process..

Now it aims to become a full-stack financial company for small businesses. To that end, it’s launched RazorPay Capital and RazorPayX, which are its lending and neo-banking services.

Throughout the last year, RazorPay has grown despite and due to the pandemic by onboarding smaller businesses new to digitized contactless payments. It has registered 5x growth in its customer base and transaction volume during the lockdown. Bullish on its growth prospects, it hired 300 people when other companies on a cost-cutting spree during the same period. With a $100mn Series D funding and a valuation of $1bn, it became a unicorn in October 2020.

8. December 2020 – Zenoti – $1billion

Zenoti turned a unicorn in December 2020. As a vertical SaaS company, it develops cloud management solutions – both ERP and CRM – for the health and wellness industry. Although Sudhir Koneru founded it in 2010, it was the product launched only in 2012.

In the past ten years, Zenoti has served 12,000 spas and salon businesses in 50 countries. Also, it raised over $250mn (including $160mn in Dec 2020), taking its valuation to well over $1bn.

Flush with funds, Zenoti plans to enter new segments like grooming. It’s recently started serving gyms and fitness centers. M&A for inorganic growth is also reportedly on the cards.

Even as most of them have moved to the USA, these startups have established the credibility of Indian-origin SaaS solutions. More companies are likely to follow suit and challenge the established legacy players.

9. Feb 2021 – Innovaccer

Innovaccer, a healthcare-focused SaaS startup, is reported to be a part of the unicorn club with $150mn in funding from Tiger Global. It was founded in 2015 by Abhinav Shashank and Kanav Hasija, and Sandeep Gupta.

The company develops digitized solutions for hospitals, clinics, and patients. By leveraging data, it enables them to improve patient assignment and automate outreach. Innovaccer’s solutions also focus on collaborative care and productivity enhancement. With the onset of the pandemic and digital transformation of healthcare, it achieved 100 percent YoY growth last year.

Indian SaaS unicorns: companies to watch out for

With 1,200 funded SaaS companies and 40+ at Series C and beyond, the list of companies to watch out for is virtually endless. Here we list six companies with solutions with unique propositions that have stood the market test and look scalable to achieve billion-dollar valuation and more.

1. BrowserStack

Ritesh Arora and Nakul Aggarwal founded BrowserStack, a cloud web and mobile testing platform in 2011. Running a tight ship, the company was bootstrapped until 2018, when it raised $50mn from Accel Partners. It subsequently moved its HQ to San Francisco.

BrowserStack enables developers to test their websites and mobile applications across on-demand browsers, operating systems, and real mobile devices. The demand shot up by 50 percent in recent months, as developers’ access to physical devices was severely curtailed during the pandemic.

2. MindTickle

MindTickle is in the business of improving Sales Readiness. It essentially helps onboard and coach sales teams, for better revenue leadership. It also provides a host of CRM and events solutions. Its customers include several Fortune 500 and Global 2000 companies.

Founded in 2011, it is led by Krishna Gopal Depura (CEO), Deepak Diwakar (CTO), and Nishant Mungali (CPO). In November 2020, it raised $100mn in debt and equity financing led by Softbank Vision Fund 2.

3. FarEye

FarEye is a logistics SaaS platform – it helps its customers conduct, track, and optimize deliveries. Its clientele includes the likes of DHL and Walmart. It claims to processes 5million transactions a day for more than 150 clients spread across 30 countries.

Why is it a company to watch out? In Aug 2020, it added $13million in taking the series D funding to $37.5million. And that totals to $51mn since it started in 2013.

In more recent news, it plans to hire 100 techies in 2021 across India and North America. When the world slowed down due to the pandemic, FarEye ramped up its growth. That makes it worthy of mention on this list.

4. Classplus

In mid-2018, Classplus, a mobile SaaS company, was started by Bhaswat Agarwal, Bikash Dash, Mukul Rustagi, and Vatsal Rustagi. The founders describe it as Shopify for coaching centers.

Classplus gave a fighting chance to tutors and coaching centers who were at a tech disadvantage. It enabled them to compete with well-funded online platforms like Byjus and Unacademy, helping them retain their paying customers, if not acquire new ones.

The pandemic and the shift to online education accelerated its growth. In May 2020, when it raised $9million in series A, it had 3,500 coaching centers onboard. Although relevant to the Indian context, the technology has global application considering the present circumstances.

5. Whatfix

Founded by Khadim Bhatti in 2014, Whatfix calls itself a digital adoption platform. It guides users – both employees and customers – through new applications. Thereby it boosts productivity, reduces training time and service tickets.

$32million Series C funding in Feb 2020 couldn’t have come at a better time for the six-year-old startup. Remote working in the past months accelerated the growth of Whatfix. While it added 130+ clients, its revenues doubled last year. And yes, it also won a lot of accolades and was recognized by Gartner and Everest Group as well.

6. LeadSquared

A sales automation platform founded in 2012 and launched a year later by Nilesh Patel, Sudhakar Gorti, and Prashant Singh, LeadSquared raised $32mn in series B funding in Dec 2020.

Its current customers include Olx, Byju’s, Kotak Securities, and Cars24. After series B, it plans to expand its sales execution and marketing automation platform to new geographies.

What binds them together

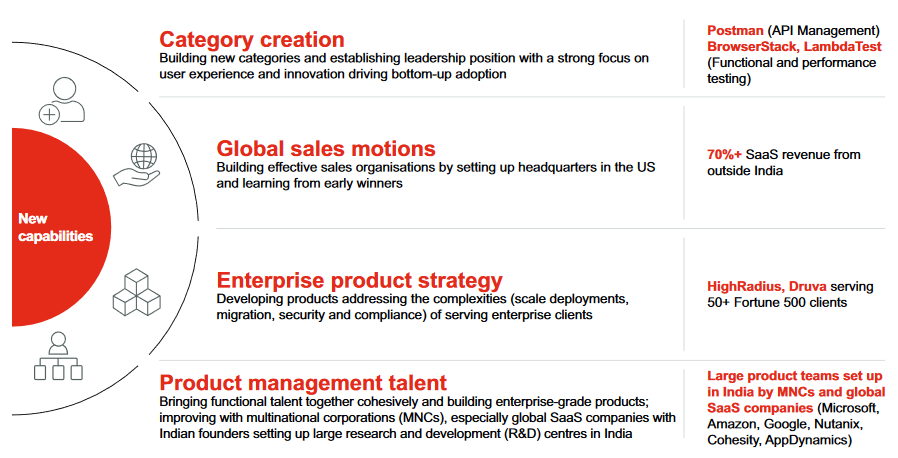

As diverse as the unicorns and soonicorns seem, a few things are common to most of them – one is the location. Even as they have Indian origins most of these startups relocate to either the US or Singapore. While serving the global customer base is a reason, registering a business in these countries far easier. These countries also provide a fertile ground for innovation and testing. Admittedly, this trend isn’t limited to SaaS startups alone.

The second commonality they operate in sectors that have benefited from the tailwinds of COVID-19. Consequently, infrastructure management platforms, collaboration tools, supply chain automation, ed-tech, and business intelligence products are increasingly attracting investor attention.

Lastly, all of them attempt to incorporate an element of intelligence or smartness into their product. AI, as it seems, is the buzz word these days.

Where is the Indian SaaS ecosystem heading?

With established credentials, cost-effective solutions, and exposure to international markets, Indian-origin SaaS solutions could witness a sudden surge in demand very soon. The trigger lies in the digital transformation forced upon various industries by COVID19.

A more startup-friendly regulatory environment, and an active focus on developing a skilled workforce, could prevent a few startups from relocating abroad. Easy access to experienced founders could help promising startups with much-required mentoring and growth funding. The resulting ecosystem would be more thriving than it is currently.

However, the changes need to occur fast to tap into the market that the pandemic has opened up.