Cloud computing has grown in popularity today, expanding into technologies, products, and services. Today, cloud computing is a multi-billion dollar economy with multiple providers competing for market share. As a consumer, it is easy to get confused by this huge cloud ecosystem. Usually, people use either Amazon Web Services, Microsoft Azure, or Google Cloud Platform. Apart from these, there are several other providers that remain a mystery. Let us try to demystify the cloud market by enumerating the different cloud services, recognizing the leading cloud providers, and exploring their cloud market share. We shall also touch upon why enterprises are moving to the cloud and the expenses involved.

There are three main types of cloud computing, each with its own range of services and cloud providers. The three main cloud computing categories are –

Table of Contents

Infrastructure as a Service

In the IaaS model, the provider gives you on-demand access to different computing elements like networking, servers, and storage. You get to run your own applications and platforms with the provider’s infrastructure. You also get a flexible hardware resource that is scalable, and subject to storage and processing needs.

Platform as a Service (PaaS)

In the PaaS model, you get access to a cloud environment where you can develop, host, and manage applications. You get a wide range of tools on the platform for testing and development. The underlying infrastructure, operating systems, and backups are the prerogative of the provider.

Software as a Service (SaaS)

In this model, the provider gives you access to cloud-based software. You don’t have to install the software on your device. You can access the provider’s application through the web or an API.

The application allows you to store and analyze your own data so you don’t have to waste time installing, managing, or upgrading software. Within each of these services, categories are 3 options – public, private, and hybrid cloud solutions.

Private Cloud

You can host your own data center or intranet on a private cloud. The ownership, management, updating, and upgrading of your cloud elements of server, networking, software, or platform resources. You have to protect it with your own firewall and security services.

Public Cloud

Under this system, the provider supplies you with access to their data center infrastructure. The provider is responsible for maintenance, cloud management, security, and updates.

Hybrid Cloud

A hybrid cloud is where you can use a mix of both private and public cloud solutions. The management of the two services is your responsibility. You also have to oversee how the two services interact, in particular the security of data passing between private and public cloud setups.

Cloud Computing Market – An Overview in 2022

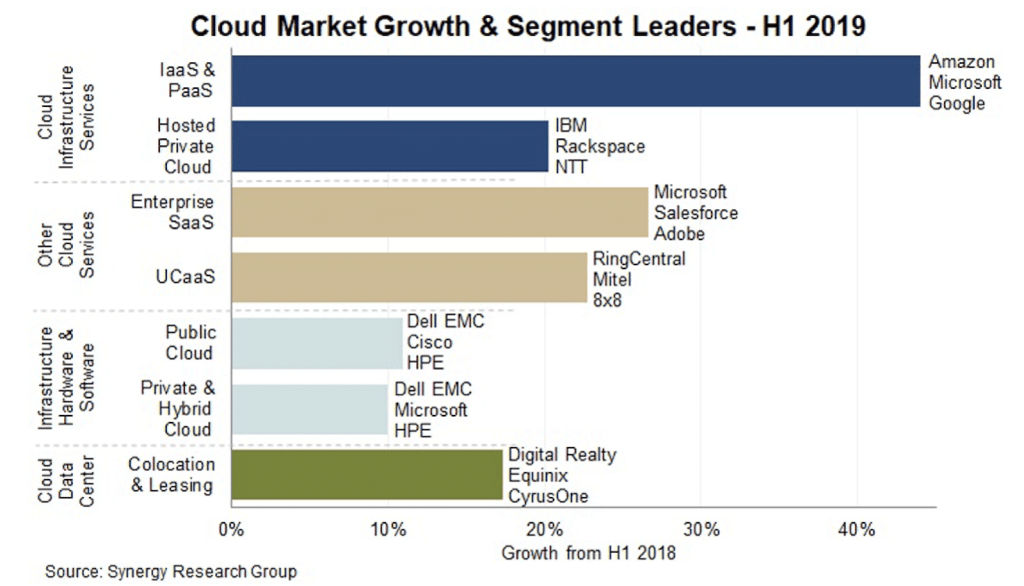

The cloud computing market is massive. According to new data from the Synergy Research Group, 7 key cloud service, and infrastructure market segments, vendors and operators make revenue in excess of $150 billion in the first half of 2019. There is still scope for expansion especially if you consider Gartner’’s projected worldwide IT spending of $3.79 trillion in 2019.

- If we observe the segments that comprise the cloud market, public cloud solutions are in the majority. This is in line with the RightScale 2019 State of Cloud Report, which states that 91% of all businesses claimed to use a public cloud service, with 72% going with a private cloud solution and 69% choosing a hybrid cloud solution.

- According to IDC projections, worldwide spending on public cloud services and infrastructure is slated to double over the next half-decade. This is unsurprising because many benefits come bundled with cloud computing. It has grown from a $229 billion run rate in 2019 to around $500 billion by 2023, facilitated by a 5-year compound annual growth rate (CAGR).

- According to the IDC, SaaS is the largest spending category which has more than half of all public cloud spending through the forecasting period. Reported as the second-largest spending, IaaS is the fastest growing with a projected 5-year CAGR of 32%. And finally, we have PaaS, the lowest spending category with the second-largest first-year CAGR of 29.9%. For a more comprehensive look at the public cloud market, let us go through some alternative research and reports.

Understanding the SaaS Public Cloud Market Share

- Healthy growth is exhibited by Software as a Service SaaS. According to data from the Synergy Research Group, software vendors are making a lot of money-$23 billion for Q1 2019, to be exact. That puts the market at an annual rate in excess of $100 billion.

- According to the report, the annual growth rate is almost 30%, corresponding closely with the IDC’s Worldwide Partic Cloud Services Spending Guide. 5 key vendors make up the worldwide SaaS market share. Combine them, and you get 51% of the worldwide SaaS cloud market share.

- Next comes Salesforce, with a SaaS market share of 12% with an annual growth rate of 21%. Next comes Adobe with a 10% SaaS market share and an annual growth rate of 29%. Next comes SAP, with a 6% SaaS market share and a 39% reported annual growth rate. Finally, we have Oracle, with a 6% SaaS market share and a 39% reported growth rate – the highest among all the five.

- Next, we have 10 vendors that makeup around 26% of the SaaS market with a growth of 26%. On the list of vendors are tech giants like Google, Cisco, IBM, ServiceNow, and Workday.

Evolution of the Saas Market

The SaaS market may appear mature, yet there is quite a lot of scope for expansion. Right now, the SaaS market accounts for just 20% of total enterprise software spending. On-premise software takes up the lion’s share of enterprise software spending. SaaS vendors are being drawn to this market to tempt businesses to adopt a cloud setup. As of 2019, the SaaS vendor landscape is divided into three parts – traditional enterprise software vendors, born-in-the-cloud vendors, and large IT vendors looking to grow in the market.

Traditional Enterprise Software Vendors

This category includes some really big names like Microsoft, SAP, IBM, and Oracle. They already have a large repository of existing on-premise customers, that they want to convert to SaaS-based subscription models.

Vendors that are born in the cloud

These companies are relatively new and are experiencing rapid expansion with healthy growth rates. Zendesk, Workday, and Atlassian are examples. What they lack is the brand recognition that comes with a big name like IBM.

Large IT Vendors

This includes companies like Google and Cisco. They are cutting out their own niche in the market thanks to services like Google workspace and the collaboration apps of Cisco.

Exploring and figuring out the IaaS and PaaS public crowd market

Things can get tricky if you want to paint an accurate picture of the IaaS and PaaS markets. Leading vendors like Amazon and Microsoft, often combine IaaS and PaaS revenues. This, plus the fact that there’s a distinct lack of transparency in their report breakdowns, and it’s simple to understand why the market is so challenging. Fortunately, reports from Gartner and IDC help us understand better.

Provider with the largest market share in Public Cloud infrastructure?

The latest data from Gartner on the worldwide Infrastructure as a Service market has a revenue of $32.4 billion. This is a 31.3% growth from what was $24.7 billion in 2017. Gartner claims the market is dominated by 5 vendors that account for nearly 80% of the IaaS cloud market share in 2018. The vendors are Amazon (47.8%), Microsoft (15.5%), Alibaba (7.7%), Google (4.0%) and IBM (1.8%). Let us look closely at the top 5 public cloud infrastructure providers in 2019. Here’s some data from combing Gartner and the provider’s revenue reports.

Amazon Web Services

Amazon is a clear market leader, owning almost half of the world’s public cloud infrastructure market. In 2018, Amazon had revenues of $15.4 billion, an increase of 26.8% over the previous year. Amazon continued leading the charts into the next year as well. In 2019, Amazon reported Q1 and Q2 added revenue of $16.1 billion, an increase of 39% from H1 2018.

Microsoft Azure

The annual revenue of Azure stands at $5 billion, a growth of 60.9% and a 15.5% market share. Microsoft carries on camouflaging mask revenue in a combined ‘commercial cloud business”. In 2019, Microsoft reported an H1 year-on-year growth of 70%. In total, Microsoft Q1 and Q2 together commercial cloud business revenue is now $20.6 billion, a 40% increase from H1 in 2018.

Alibaba

Alibaba owns a decent 7.7% of the public cloud market share as mentioned by Gartner. With annual revenues of $2.49 billion and awesome growth of 92.6% in 2018, this eCommerce entity carries on its amazing growth into 2019, with combined revenues of $2.2 billion, an increase of 66% for Q1 and Q2. This means the company’s annual revenue rate is a little more than $4 billion.

Google Cloud Platform

Gartner estimates that Google’s Cloud Platform has a public cloud market share of 4%, with annual revenues touching $1.3 billion chalking up a 60% growth in 2018. In 2019, Google was on par with Alibaba, with cloud service revenues at $8 billion.

IBM

Gartner claims that IBM has a 1.8% market share. Its annual revenues hit $577 million with a growth rate of 24% in 2018. IBM is well-known for hybrid cloud services and has acquired fellow IaaS provider Red Hat for $34 billion.

Why are businesses migrating to the cloud?

There are many reasons why businesses move to the cloud. However, some common reasons lead firms to make the change. Here are the reasons which could lead your business to move to a cloud-based ecosystem.

Added Benefits

Cloud computing offers a slew of benefits. Greater flexibility, security, and scalability are some of the reasons.

End of Life Events

All products, whether hardware or software, have a life cycle. If a vendor announces an end-of-life event, it’s a great chance for you to check out alternative solutions. Businesses are jumping on these opportunities to move from on-premise to cloud-based solutions. You can decommission old licenses and hardware, and avoid the security risk of running a solution post an end-of-life event.

Official Acquisitions

Applications and technology can be incompatible once companies merge. More so if you need to consider managing these landscapes across multiple data centers. Migrating applications and technologies to the cloud might be the best solution. A smooth transition with a consistent solution will help you seamlessly take into account new geographies and employees moving forward.

Contract Renewals

A lot of firms have contracts with private data centers, software, and hardware providers that need to be periodically renewed. Like an end-of-life event, this gives you the chance to reconsider the way you employ certain services and solutions. Making the transition to a more cost-effective cloud-based solution is the best option when faced with increasing cost bases and a number of other limiting factors.

Compliance

Data compliance is one of the most important factors of business operations, especially if you are in the financial services or healthcare industry. For those that operate on-premise solutions, it can be quite challenging to manage the constantly evolving and changing compliance regulations. If you shift to the cloud, on the other hand, you can choose services that are already compliant. The cloud provider is held responsible for any updates in case these compliance regulations change.

Security Risks

Cyber attacks nowadays are highly prevalent and increasing in scale. A lot of businesses might lack the tools and talent to deal with this. However, migrating to a public cloud gives you a ready-made solution to minimize risk. Cloud providers also employ a number of resources to protect against imminent threats.

Capacity Requirements

You might face hardware utilization while having rapid growth or season capacity shifts. If you are unable to meet business demands or pay for on-premise underutilized services, costs can go up. Moving to the cloud gives you the flexibility to increase and decrease costs using a pay-as-you-go model.

Software and hardware refresh cycles

If you manage an on-premise data center or software application, it is your responsibility for keeping each and every aspect up to date. While considering a refresh cycle that’s coming up, you may find it less expensive and quite beneficial for transitioning to the cloud. Investing in a SaaS subscription or lifting and shifting the application into the public cloud may provide cost savings as opposed to using on-premise software licenses and hardware updates.

Conclusion

Thus, the above points sum up the cloud ecosystem succinctly. Whether you are a small business that is just getting started or a large enterprise in the throes of action, investing in the cloud can improve your business processes and reduce costs.

Read More

A Comprehensive Guide to Machine Learning Software

CRM & Marketing Automation: Differences & Benefits of both the Software