Revenue management is an important aspect of achieving corporate success. However, streamlining it with the government’s GST regulations can become a lengthy and tedious task. Manual handling of GST is often prone to miscalculations that can cause a major setback in the company’s growth. That’s why entrepreneurs are now implementing GST software for automated GST calculations that comply with the accepted legal norms.

GST software serves as a multi-functional platform. In addition to the GST costing, it can also effectively manage inventories, finance, accounts, invoicing, and tax e-filing process. There are many GST software available in the market today. Users can choose the best-suited software based on their business scale and needs.

However, for a beginner, it can be a bit difficult to understand the feasibility and relevance of GST software. So, to get hands-on experience users can first try the free platforms. In this article, we have listed the best free GST software for business in 2021. These software work well for businesses of all sizes.

Table of Contents

What are the features offered by a GST software?

Following are the standard features that GST software must possess to function optimally. Users should look for these features before finalizing GST software for their business –

- GST auto-calculation

- Account management

- Inventory management

- Online banking integration

- Multi-user login

- Invoice management

- Scalability

- Cloud support technology

- GST-ready reports

- Data security

- Tax filing

Which are the 5 best free GST software for business?

Based on the features discussed above, the following are the 5 best free GST software for business in 2021.

1. Vyapar

Vyapar is GST-ready accounting software that is used for billing and tax filing. It is one of the best GST billing software. Its quality services are scalable and can be implemented for businesses of all sizes. It offers a cloud-based solution with multi-user login features. This allows remote access to data and works well for businesses with a distributed workforce.

Vyapar is compatible with Windows and can be easily installed in a system. The only requirement for its function is a good internet connection. Vyapar can also be used in smartphones. It is compatible with the Android operating system. In addition to GST management, users can also perform financial accounting, budgeting, POS invoicing, revenue management, inventory management, cash flow tracking, and more. Features of this software can be customized based on the business needs.

Key features

- GST management

- Cash management

- Inventory management

- Billing and invoicing

- Tax management

- Expense tracking

- Project accounting

- Revenue recognition

- Multi-user login

- Mobile support

- Scalable

Pricing

If you are looking for a lifetime free GST billing software, Vyapar offers a freemium version on its mobile app where all the key functionalities are available without any charges. Users can easily manage their business accounts on mobile phones by using the Vyapar app. Paid subscription plans that start at $19/year also offer a free trial version that can be tried before making the final purchase.

2. HDPOS Smart

HDPOS is a smart GST accounting tool. It can be used directly as cloud-based software on the web and can also be installed on a PC. HDPOS offers key business functionalities that users can implement in their business for increased productivity. It can manage and automate crucial tasks like invoicing, billing, creating a financial budget, and business forecasting. It also takes care of the tax-related documentation for timely e-filing and application for return.

HDPOS operates in compliance with the government’s GST rules and regulations. It generates regular GST tax and audit reports to keep track of the cash flow and improve revenue management. It also stores the backup history of the transactions made in the past. So, users can retrieve relevant data whenever required. This software comes integrated with banking, accounting, and security features for safely carrying out multi-currency transactions.

Key features

- Secure payment gateways

- Customized invoices

- Stock handling and reporting

- Inventory management

- Customer profiles

- Data backup

- Barcode scanning

- Loyalty program

- Online customer support

- Remote accessibility

- POS integration

- Scalable

- Multi-user login

Pricing

HDPOS offers a free trial on its subscription plans that start at $45/month. Users can also buy a one-time license for the same.

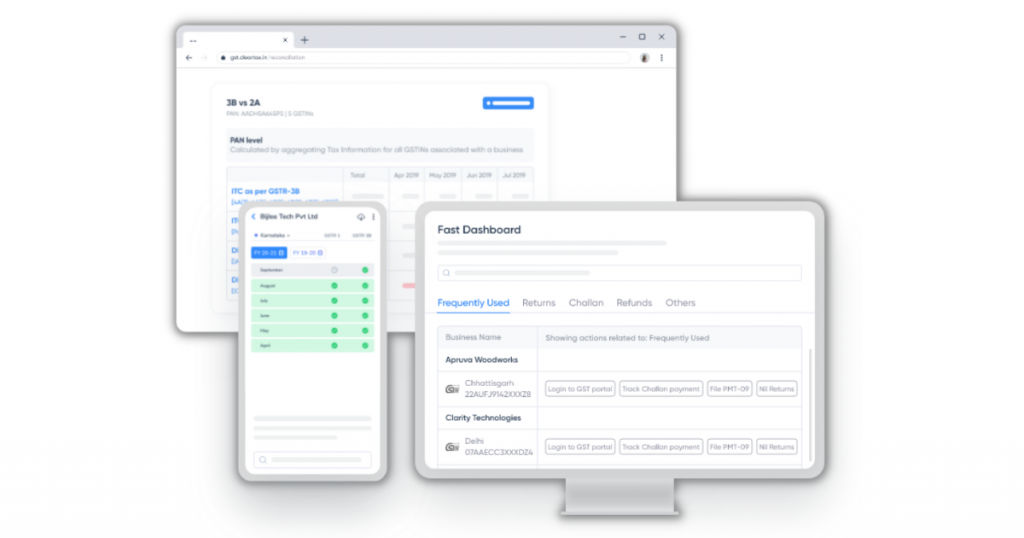

3. ClearTax

ClearTax is also one of the best GST billing software. It is available as cloud-based software as well as a SaaS application with Android and Windows compatibility. It works in compliance with the government’s tax regulations. With this software, users can easily track their GST transactions and file income tax return in time without any hassle.

Cleartax has an intuitive user interface that comes with an easy-to-follow guide for filing income tax returns. With mobile phone compatibility, users can also access their data even from remote locations. It provides bank-grade security for all the data stored in its servers. Users can also take advantage of the in-built invoicing tool that allows them to generate customized invoices based on their business needs. ClearTax also creates a backup of the company’s audit trails for future reference.

Key features

- Inventory management

- Intuitive dashboard

- GST reports

- Mobile support

- Accounting features

- Multi-user login

- Invoicing tool

- Scalable

- Online customer support

Pricing

Users can customize their subscription plans based on their business needs. A quotation has to be requested for pricing details. They offer a free trial on their subscription plans that users can avail before making the final purchase.

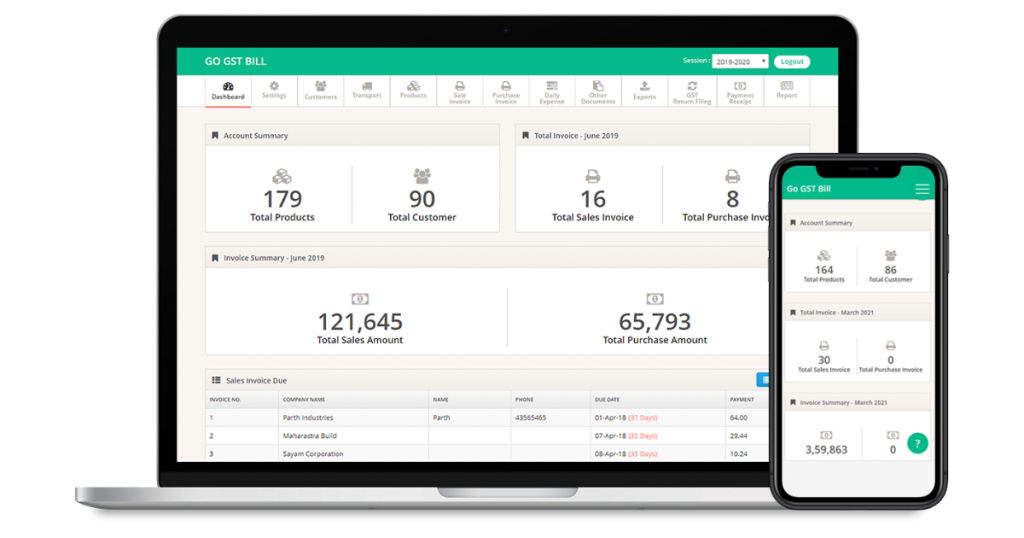

4. GoGSTBill

GoGSTBill is an easy-to-use GST billing software. It comes integrated with a POS management tool for seamless implementation into business. It offers a variety of features that users can utilize to generate quotations, and create proforma invoices that are in compliance with legal GST norms.

GoGSTBill software provides regular reports on GST billing, cash flow, business turnover, and company ledger. Users can utilize these features to optimize business operations and improve revenue management. It can be used for multi-national companies and foreign collaborations as it supports multi-currency transactions. Some of the leading features of GoGSTBill are as follows –

- Payment gateway

- Billing and invoicing

- Customer profile management

- Accounts management

- Inventory management

- Online customer support

- Windows and Mac compatibility

- Scalable

- GST-ready reports

- Tax filing

- Data security

Pricing

GoGSTBill offers a freemium plan for its users that allows users to avail themselves of unlimited features like sales invoices, product management, sales reports, and more without any charges. It also offers a free trial on its paid subscription plans that start at $14.12/year. Users can also buy a one-time license at $84.83 and implement its offline version.

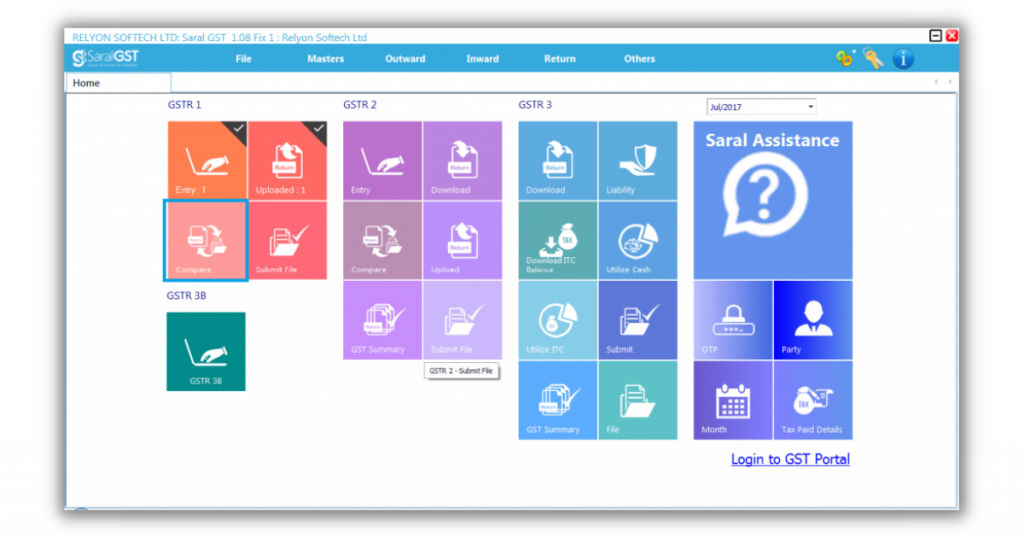

5. Saral GST

Saral GST is a comprehensive tax filing management software. Users can manage both the input tax credit and output supplies with this software. It maintains data integrity and data security by proving in-built tools. Users can also customize the invoices based on their business needs.

Saral GST works in integration with payment gateways allowing users to directly pay their taxes through credit card, debit card, NEFT, or RGTS. Users can also manage inventory and e-filing for GST returns through this platform. Some of the key features of Saral GST include –

- Online banking integration

- Multi-currency support

- Billing and invoicing

- Multi-user login

- GST-ready reports

- Payment gateway

- Online customer support

- Scalable

- Inventory management

- Accounting management

Pricing

Saral GST offers a free trial on its paid plans. Standard plans start at INR 6900 for a single user and INR 15000 for a multi-user login with unlimited features.

Conclusion

Businesses deal with multiple transactions every day and it can be difficult to process them in compliance with GST regulations manually. This is where GST software brings an advantage. Users can use GST software to automate billing processes, invoicing, tax e-filing, and more and minimize manual errors.

In this article, we listed and discussed the 5 best free GST tools that are available in the market. Users can try these platforms to understand their functioning and feasibility in business before purchasing an advanced plan.

If you wish to know more, you can visit us at SaaSworthy.

Also read:

• 5 Best Free Personal Finance Software to Use in 2021

• 6 Best Free Fax Software to Use in 2021: A Detailed Comparison

![10 Best Free and Open-Source Landscape Design Software in 2024 [Updated] SaaSworthy Blog Header](https://images.saasworthy.com/blog_latest/wp-content/uploads/2021/04/Blog-Header-Image.png)